‘Optimistic’ about Mideast

Germany’s Mechanical Engineering Industry Association or VDMA has seen sales grow in the region after a temporary decline and is buoyant about the future.

01 March 2018

Having ended 2017 on a high note, the German construction equipment industry is expecting 2018 to be another good year, with an eight per cent increase in turnover predicted.

In the Middle East, German construction equipment machinery exports have returned to growth, increasing by approximately five per cent after moderate sales declines of about 10 per cent in 2017.

“This was fuelled by soaring exports to the UAE which grew at a rate beyond 50 per cent,” an economic expert from the Mechanical Engineering Industry Association or VDMA (Verband Deutscher Maschinen-und Anlagenbau) tells Gulf Construction.

The UAE is Germany’s largest export market in the Middle East and makes up one-third of total sales in the region. “German manufacturers continue to be optimistic about the Middle East markets. In a recent VDMA survey, 40 per cent of manufacturers expect this region to be among the major growth markets in 2018,” he says.

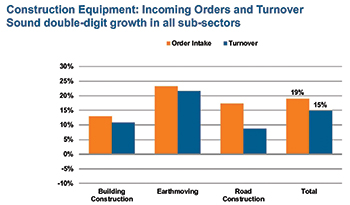

Overall, in 2017, the German construction equipment industry recorded a turnover of €10.8 billion ($13.4 billion) – an increase of 15 per cent compared to the previous year. It is the fourth consecutive year of growth for the sector. Incoming orders were 19 per cent higher by the year-end.

Hence, 2018 is expected to be another good year for the industry with the boom set to continue into 2019.

“We have not felt this kind of unanimous, great optimism for many years,” comments Joachim Strobel, managing director of Liebherr-EMtec and industry spokesman of the German Construction Equipment Manufacturers of VDMA on the positive atmosphere among his colleagues at their annual meeting in Frankfurt.

|

|

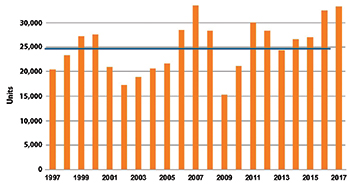

German earthmoving equipment sales. |

The companies generated considerable growth in all sub-segments in 2017, with the largest increase coming in earthmoving equipment (up 21 per cent), followed by building equipment (up 11 per cent) and road construction machinery (up nine per cent).

“We are benefiting from simultaneous high demand around the globe,” adds Franz-Josef Paus, chairman of the Construction Equipment and Plant Engineering Association of VDMA and managing partner of Hermann Paus Maschinenfabrik. “There are no signs that this will change this year. The boom will carry us into 2019.”

This is also why the manufacturers are looking forward to bauma, the world’s leading trade fair for the sector that will take place in Munich, Germany, in April next year.

The German market was the driving force behind 2017’s positive developments. Here, the manufacturers were able to add another three per cent to an already high level of sales. “This scale was surprising,” says Strobel.

The compact machines segment was the main reason this growth was not larger. After soaring over the past two years, it is clearly starting to become saturated, with single-digit negative growth.

About 20 per cent more construction machines were sold in Europe last year than in 2016. Construction equipment sales reached record levels in northern and western Europe, while demand in southern and central Europe rose considerably, albeit from a low starting point. Russia continues to cause the manufacturers some concern, despite the recent recovery. In the once booming market, German manufacturers are not yet back to where they once were.

“We are finding it difficult to rebuild the trust that was lost through the EU sanctions,” explains Strobel.

Globally, the construction machinery sector turnover grew by around 15 per cent in 2017, almost reaching 2011 levels again at about €116 billion.

“As of yet, the growth shows no signs of a bubble. Customers in all sub-segments are working to capacity, the capital is there, the situation on the raw materials markets is improving and businesses are profiting from a macroeconomic tailwind. Markets appear to be opening up one after the other,” says Paus.

With a sales upturn in double digits in construction machinery, North America was approaching its record figures from 2006 at the end of 2017. In South America, the manufacturers recorded a sales upturn of 26 per cent. This was brought on not by Brazil, but by Chile, Peru and Argentina. Argentina, in particular, is a market with great potential and deserves closer attention, according to the manufacturers.

The Indian market grew for the second year in a row, by 12 per cent, but remains small compared to China.

After five years of sometimes extreme downturns, the Chinese market positively exploded in 2017 (up 86 per cent) and is now the largest construction machinery market worldwide once again. However, despite apparent market consolidations, China remains highly volatile and lacks the desired sustainability.

According to an IFO Institute economic research report, the capacity utilisation of the German manufacturers of construction machinery and building material plants was at 89 per cent in early 2018.

In addition to materials shortages, staff shortages will also be a limiting factor in 2018. Long delivery times from component suppliers are the downside of the high number of orders in many sub-segments. However, industry representatives do see positive aspects to this limitation. Among other things, it promises slower and healthier upward development than has been seen in the past.

“Finding qualified staff in this unusual boom phase is the second major challenge facing the industry. There is not only a lack of engineers and technicians, but also of people who can operate construction machinery,” says Paus.

With 40,000 employees, the mainly medium-sized businesses in the construction and building material plant industry play an important part in securing industrial jobs in Germany. They provide a professional home for numerous people with a huge range of qualifications and do so with practically no precarious employment conditions. The manufacturers believe it should stay that way.

- ‘Optimistic’ about Mideast

- ib vogt starts work on Egypt solar plants

- Peri helps raise Bee’ah’s profile

- Bauer Resources signs up with Masdar