Global aviation hubs

Mega developments continue to be pursued in the region as each of the GCC states aspires to attain an aviation hub status to tap not only the booming global travel industry but also expand its air cargo handling capacity.

01 July 2019

Positioned between the Western and Eastern hemispheres, the Gulf region continues to push ahead with its ambitions to capitalise on its strategic location and boost its infrastructure as a major global aviation hub.

According to media reports, the Middle East is expected to invest some $90 billion in the aviation industry by 2020 with more than three-fourths of this being spent by the Gulf states alone. This investment is going into the establishment 64 new airport projects in the Middle East, says CAPA (Centre for Aviation), a trusted source of market intelligence for the aviation and travel industry, as well as in the expansion and modernisation of existing facilities.

Each of the GCC states has major plans under way to expand aviation infrastructure. Heading the league is the UAE which is investing up to $50 billion in new and expanded projects over the next 15 years, which will provide capacity for an additional 200 million passengers per annum, according to figures released by CAPA.

Bahrain

Work is ongoing on the Airport Modernisation Programme, which is expected to be completed later this year. As part of the programme, a new 210,000-sq-m terminal is currently being built, and operational readiness trials of the new terminal are under way and expected to continue until September.

The $1.1-billion expansion is being financed by the Abu Dhabi Fund for Development as part of a GCC financial assistance package pledged to Bahrain in 2011.

The new terminal building, which is expected to open in October, is four times the size of the existing terminal and will include a 4,600-sq-m departure hall, 104 check-in counters, 36 passport control booths and 24 security screening points.

Once fully completed, the expansion project will increase the airport’s annual passenger capacity from nine million to 14 million, besides introducing 25 Mars airbridges and a state-of-the-art automated early baggage storage (EBS) system, as well as a multi-storey car-park increasing the parking space to 2,700 vehicles.

Among other developments, the Civil Aviation Affairs (CAA) building, which once served as the kingdom’s main airport, will be transformed into a private aviation terminal to cater to VIPs and business leaders.

Plans have also been mooted for a second airport for Bahrain in 15 years.

|

|

The new T2 terminal is taking shape at Kuwait International Airport. |

Kuwait

Major developments have been launched at Kuwait International Airport, where a new state-of-the-art terminal (T2) is currently taking shape. Among the latest contract awards for the development of this aviation hub was the appointment of Obermeyer, one of Germany’s oldest engineering consultancies, to manage key future projects at Kuwait International Airport. The contract, valid for five years, envisages management of current and planned ventures, such as building the third runway and a new observation tower.

Future projects for the airport include overhauling the western runway and building three others, two observation towers, and additional passenger terminals after the completion of the T2 terminal.

The new terminal will have a capacity of 25 million passengers annually and is scheduled to complete by 2022.

Kuwait is also building a new cargo city on an area of 3 million sq m, work on the first stage of which is now in progress.

In July last year, a $61-million contract was awarded for the design and expansion of the runway adjacent to T2. During the same month, Kuwait International Airport officially opened its new terminal (T4), which was built at a cost of $174.5 million.

Kuwait too announced plans last year for a new $12-billion greenfield airport with a capacity of 25 million passengers a year. The new world-class airport is expected to be located in northern Kuwait and be developed by the private sector on a build-operate basis on land allocated by the government.

|

|

Muscat International Airport ... 56 million passengers per annum capacity. |

Oman

In November last year, Muscat International Airport formally opened its new international terminal which has been designed to accommodate up to 56 million passengers per annum to meet “future demands”, providing it with adequate capacity at current growth rates for the next 10 years, according to a CAPA report.

Last year also saw the opening of a new terminal at Duqm Airport, which is expected to be developed as a logistics hub. The terminal building spans 8,660 sq m and has a capacity for 500,000 passengers annually, with the potential to expand to two million.

A cargo village is being planned to increase the airport’s airfreight and logistics revenue by $77.9 million. The proposed site will house storage, warehousing, freight handling, forwarding, customs, inspection services, shipping, repackaging and distribution facilities, and will feature multi-modal transport infrastructure. It will have the capacity for 250,000 tonnes of cargo per annum, the report states.

Other regional airports are also under development in Sohar and Ras Al Hadd, while studies are in progress for a facility at Musandam.

|

|

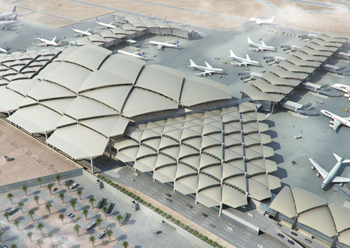

A rendition of Khaled International Airport ... two terminals are being redeveloped. |

Saudi Arabia

Saudi Arabia is expanding its airport infrastructure adding to its current tally which includes 27 airports across the kingdom.

Work is well advanced on the expansion of Saudi Arabia’s second biggest airport – King Khaled International Airport in Riyadh, where terminals 3 and 4 are being redeveloped following the completion of Terminal 5 in 2016.

In March this year, Egis was awarded a contract by Riyadh Airports Company for design and project management consultancy services to replace hold baggage screening (HBS) machines in Terminal 5.

Egis has been supporting the transformation at Riyadh Airport for five years now through major airside upgrade of taxiways and apron and systems and equipment upgrade with the replacement of passenger boarding bridges, 400Hz power units and pre-conditioned air.

Major expansion is also planned for yet another key international airport: Dammam Airports Company (DACO) is embarking on a significant expansion of the facilities and passenger and cargo handling capacities at King Fahd International airport in Dammam.

According to Daco’s CEP Turki Abdullah Aljawini, the expansion is aimed at increasing the passenger capacity to 15 million next year from the 10 million last year.

The airport authority is also planning to establish a bonded zone, similar to airport free zones elsewhere, for cargo handling.

Meanwhile, work was also launched last year on a new SR2.5-billion terminal at King Abdullah airport in Jizan, with a capacity to handle 3.6 million passengers annually, and at Qunfudah, which will serve 500,000 passengers annually and include three halls, a runway, a road network, a control tower, a car park and service venues.

In addition, the current airport at Sharma is being upgraded to become a commercial airport operating regular flights between Riyadh and the $500-billion mega Neom development. Now known as Neom Bay Airport, it was inaugurated late last month and is the first 5G-supported airport in the region.

Other plans include redevelopment of the airports in Abha, Qassim, Arar and Hail. There are also plans to develop new airports in Farasan Island and Taif.

|

|

Al Maktoum International Airport ... major expansion plans on cards. |

UAE

Work is under way on the expansion of airports in four of the six UAE emirates, the most awaited being the new Midfield Terminal being built at Abu Dhabi International Airport at cost of Dh10 billion. Now expected to open later this year, the state-of-the-art facility is designed to handle up to 84 million passengers per year.

Meanwhile, to accommodate the growing number of business and leisure visitors entering or transiting Dubai, the emirate has been continuously expanding and upgrading Dubai International Airport, which welcomed more than 89.1 million passengers in 2018.

Dubai also has plans for a major expansion of its second airport, Al Maktoum International Airport, which is set to become the primary airport for the emirate, as well as the home to Emirates airline from 2025. A contract award is expected shortly for the largest substructure package in the world for the development. Dubai’s second airport is designed to be the world’s largest global gateway with a capacity for more than 160 million passengers per year.

In Sharjah, tenders were issued recently for the main works and for the relocation of utilities, the building substructure, superstructure skeleton and other associated works involved in its $408-million airport expansion project. The plan includes the expansion of the terminal building and increasing the airport’s capacity to 20 million passengers by 2025 (see Page 43).

Fujairah International Airport too is undergoing a $180-million expansion, following the recent award of a $180-million deal to a consortium of Orascom Construction (ORAS) and UAE’s Al Sahraa Holding Company to develop the facility.

And in Ras Al Khaimah, extensive renovation work, which included the duty free area, was recently completed at the emirate’s international airport.

- Global aviation hubs

- RMD Kwikform geared to tackle complex issues

- Sharjah issues tenders for airport expansion

- Gaca spearheads Saudi aviation ambitions

- Haulotte flies high at Istanbul airport