Circular technologies the way forward

Concrete and cement circularity could allow the building and construction industry to rein in costs and reduce emissions, adding untapped value to the built environment, according to a report by McKinsey & Company*.

01 April 2023

Cement and concrete manufacturers should be looking long term at offering cement not as a material but as a sustainable solution and service, and this can be done by adopting circular technologies targeting three areas – energy, carbon dioxide and materials and minerals, according to experts at McKinsey & Company.

By adopting circular technologies, players in the cement and construction value chain can mitigate around half the environmental risks posed by producing these materials which are a major contributor to global carbon emissions1.

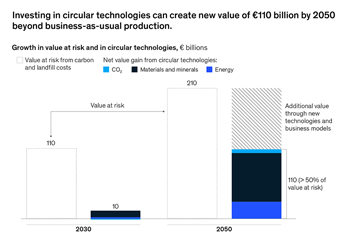

According to research conducted by McKinsey, net value gains can be achieved by adopting circular technologies. The recirculation of carbon dioxide, materials and minerals, and energy can have a financial impact worth €110 billion on the built environment by 2050, thus mitigating almost half of the costs and risks involved through buying carbon credits and landfill costs estimated at $210 billion (see graph).

The experts estimate the annual net impact of recirculating carbon could be €6 billion on a global average; while recirculating materials and minerals can save nearly €80 billion annually; and the total annual net value gain from recirculating energy could be €24 billion by 2050.

In view of the fact that builders and homeowners are increasingly seeking sustainable, affordable, durable, and flexible structures, the cement and concrete products industries need to adopt a customer-centric approach to explore new opportunities for green-business building, which could propel the development of new technologies, says the report.

Global demand for cement and concrete has tripled over the past two decades. With a growing number of industries and sectors moving toward net-zero emissions, a significant amount of value is at stake in cement, given the cost of buying carbon credits and the cost of landfill for construction and demolition waste (CDW).

As demand for cement and concrete is expected to remain consistent in the coming decades, industry players will need to explore circular technologies involving use of alternative fuels, carbon curing, recarbonation, and carbon capture and storage (CCS)2, which according to McKinsey’s research could help to decarbonise roughly 80 per cent of total cement and concrete emissions by 2050.3

Circular economies based on the principles of eliminating waste and pollution, recirculating products and materials, and regenerating nature and circular technologies follow the paradigm of three decarbonisation strategies: redesign, reduce, and repurpose.4

Hence, addressing the volumens of materials needed through redesigning materials, buildings, and infrastructure can play a critical role in changing how industry leaders approach projects; shifting from fossil to alternative fuels can help reduce emissions and repurposing and repairing existing assets and infrastructure can help limit the need for new ones. It is also important to reduce clinker in cement through substitutes, the volume of cement in concrete through less overspecification by design, and the volume of concrete in the built environment through alternative building materials.

The carbon footprint can be reduced by capturing carbon dioxide and utilising it in curing readymix or precast concrete.

Recirculating materials and minerals will have the largest financial impact, says the report and this includes the use of CDW as aggregates for concrete production, thus avoiding landfill costs and the costs of virgin material.

There is vast potential for saving energy costs – specifically alternative fuels from waste material. In addition, cement and concrete production can provide an offtake opportunity for waste material, which could be supplied for free or even at a negative cost by the producing industries, say the McKinsey experts. Some 30 to 40 per cent of today’s solid waste is created through the construction and maintenance of the built environment.5

By using circular technologies, roughly two billion metric tons of carbon dioxide emissions could be avoided or mitigated by 2050, according to the research.

To explore new avenues for growth and create added value, cement players should engage in circular business building. This involves engaging in activities that facilitate circularity along the value chain and deliver the value of circularity to consumers. Construction companies, waste providers, new players, and building materials manufacturers alike can consider digital marketplaces for waste materials. At the same time, technologies that facilitate design and standardisation are expected to increase potential value pools, enabling technology providers and designers to secure a significant stake in the overall opportunities afforded.

In addition, increasing customer-centricity will likely create new opportunities across the built environment. For example, by addressing the demand for affordable and flexible housing, owners can participate in the design of their homes. Precast building modules can also be provided to customers in a lease-like mechanism, which can be facilitated either directly by cement and concrete players or through construction companies that have direct offtake agreements with materials producers.

To reduce the carbon footprint, cement manufacturers can explore carbon dioxide offtake opportunities in other industries. Captured and concentrated carbon dioxide can be transported – by pipeline or by trucks – to places where it can be used as an input. The challenge is to create viable business models for both the cement industry and offtakers, which highlights the need for increased collaboration across industries.

With a growing number of construction companies joining the Race to Zero campaign by the United Nations Framework Convention on Climate Change and the increasing demand that building materials must meet sustainable criteria, cement and concrete manufacturers need to act now to derive benefits of circularity.

References:

1. Thomas Czigler, Sebastian Reiter, Patrick Schulze, and Ken Somers, “Laying the foundation for zero-carbon cement,” McKinsey, May 14, 2020.

2. For cement, we typically define this term as carbon capture and storage or utilization in other industries, such as chemicals. However, there are some carbon capture and utilization opportunities in construction, such as carbon curing.

3. Based on demand of four billion metric tons.

4. Thomas Hundertmark, Sebastian Reiter, and Patrick Schulze, “Green growth avenues in the cement ecosystem,” McKinsey, December 16, 2021.

5. Santiago Gassó Domingo, Luis Alberto López Ruiz, Xavier Roca Ramón, “The circular economy in the construction and demolition waste sector – a review and an integrative model approach,” Journal of Cleaner Production, March 2020, Volume 248.

* The McKinsey report can be viewed at https://www.mckinsey.com/industries/engineering-construction-and-building-materials/our-insights/the-circular-cement-value-chain-sustainable-and-profitable.

- Circular technologies the way forward

- JV aims for future of low-carbon concrete

- First DAC-to-concrete facility on way

- New PCM process to keep homes cool

- Vegetal concrete helps achieve green goals