Prospects brighter

Despite its oil wealth and ambitious Vision 2035 plan, Kuwait continues to grapple with bureaucratic and procedural hurdles in its developmental journey. However, according to a recent NBK report, prospects for progressing key reforms appear stronger than in previous years. This is much needed to drive the country’s mega projects that target infrastructure, housing and renewable energy.

01 April 2024

Kuwait is a nation that boasts the world’s sixth-largest known oil reserves and a population of just around 4.25 million. Yet, it faces a number of challenges in translating its oil wealth into broader economic development. Bureaucracy and political stalemate have hampered progress – issues that Kuwait’s new ruler acknowledged when he addressed the parliament as he took on the reigns of the country at the end of last year.

The country has witnessed frequent government turnovers (eight formed between December 2020 and December 2023) due to clashes between the executive and legislative branches of parliament. It is this issue that HH Sheikh Mishal Al Ahmad Al Sabah will be keen to resolve as he takes the country onwards on the path to reform and progress.

Kuwait is unlikely to boost spending in the short term with the budget for the next fiscal year starting April (FY24/25) projecting yet another large deficit – the ninth in the past decade. Although higher oil prices are likely to reduce the budget gap, the country will increasingly seek foreign investment and private sector participation to drive its ambitious Kuwait Vision 2035 plan.

With oil being its main revenue earner, Kuwait intends to invest around $10 billion annually over the next five years in the oil sector.

Among the mega infrastructure developments under way are the $4.3-billion Kuwait Airport expansion (Terminal 2) and the $1.4-billion Umm Al-Hayman Wastewater Treatment Plant expansion. Other big-ticket projects proposed including the new airport in northern Kuwait, valued at $12 billion, the South Al-Mutlaa City project, worth $11.6 billion, the $6.9-billion Al Zour North IWPP and the $5.5-billion South Saad Al-Abdullah Residential City.

Plans to build the 1,001-m-high Burj Mubarak Al Kabir – initially proposed in the 1990s as a centrepiece of the Madinat Al Hareer (Silk City) in the Subiya district of Kuwait City – resurfaced early last year, but there have been no further announcements on the ambitious development.

In the annual plan for 2023-24 which concluded last month, nearly KD1 billion ($3.3 billion) was allocated for development projects. This comprised KD886 million for 20 large projects, said the Arabic language daily Al Qabas, quoting a government report. These large projects included Kuwait’s airport expansion at a cost of around KD158 million, of which around 19 per cent has been spent. Other projects comprise Mutlaa Residential City, two other housing projects, Al-Zour Refinery, Al-Sabah University, Al-Addan Hospital, a new medical city and Al-Shuaiba Port expansion.

|

|

The 64-sq-km South Saad Al-Abdullah Residential City ... China Gezhouba Group Company broke ground on the project early this year. |

Quoting a report issued by the General Secretariat of the Supreme Council for Planning and Development (GSSCPD) on the status of the 2023/2024 annual plan projects, Al Qabas also indicated that some 77 per cent of the projects were behind schedule. The report revealed that the percentage of spending on projects at the end of September amounted to 10.6 per cent out of the total budgeted KD1 billion. According to the report, projects have suffered due to administrative, regulatory, technical and legislative challenges.

Looking ahead, prospects for progressing key reforms appear stronger than in previous years, amid a greater sense of political urgency, according to a recent NBK report.

Meanwhile, NBK’s latest Economic Research report states that solid activity is expected for the year, although project awards in Kuwait was soft in February. The value of awarded projects in February came in at KD43 million (-54% y/y), bringing the cumulative year-to-date total to KD81 million (-72% y/y), said the report quoting MEED Projects. Two out of the three awarded projects during the month related to the construction of public buildings in Al-Mutlaa City by the Public Authority for Housing Welfare (PAHW), the report said.

Kuwait’s current development plan 2024-25 has outlined three priorities that impact the construction sector and involve a concerted drive to encourage private sector investment: It calls for setting up a special international economic zone; developing a cohesive infrastructure; and creating sustainable living areas.

The new economic zone, which will be the country’s largest, will be located in northern Kuwait, and have an independent institutional structure that ensures its global investment appeal.

The plan places an outlay of KD428 million on developing Kuwait’s infrastructure in line with the state’s vision of transforming into a financial and commercial centre. Its goal is to provide advanced land, sea, and air transportation networks as well as a competitive information technology sector.

In terms of a sustainable living environment, a budget of KD37.65 million has been set aside to rationalise the use of natural resources and reduce pollution rates, increase the percentage of energy production from renewable sources, achieving integrated water resources, high air quality and improving the solid waste management systems.

|

|

The 789-bed Maternity Hospital along the Kuwait Bay coast within the Al-Sabah Health Zone ... one of the newly completed projects in Kuwait. |

Kuwait’s longer-term plans also include the creation of companies specialised in the construction of new residential cities and other housing projects and a project to build a railway line linking the Saudi and Kuwait capital cities.

Kuwait is now encouraging private sector participation and improving government efficiency. It has received major interest from China; Chinese companies are already engaged in developing one of its largest residential cities – South Saad Al-Abdullah housing scheme. The two nations have reached an agreement for bilateral cooperation from 2024 to 2028, focusing on renewable energy, infrastructure construction and environmental governance. Seven memoranda of understanding (MoUs) have been signed covering the completion of Mubarak Al Kabeer Port; and for projects including renewable energy, creation of a green low-carbon waste recycling system, wastewater treatment station infrastructure, and economic and free zones.

Airport & Port

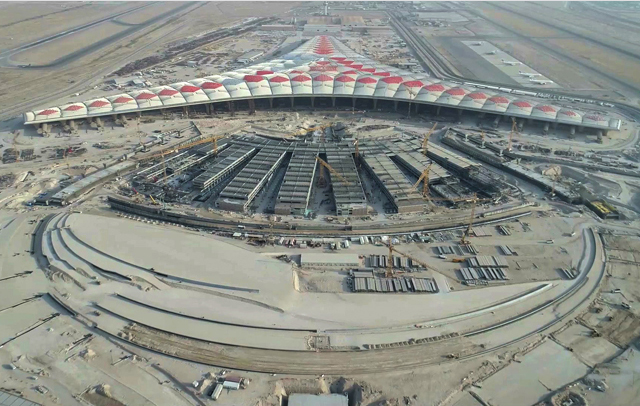

Work on the Kuwait International Airport T2 project, designed by the acclaimed architecture firm Foster + Partners, is well advanced. Construction is being carried out by Limak İnşaat of Turkey, which is currently managing the construction of the Kuwait International Airport Terminal 2 (T2) project’s Package One, involving a new state-of-the-art airport terminal building, and Package Two, which comprises a car park, service buildings, and roads leading to T2.

Last October, Limak secured yet another contract, worth KD236 million to build a package of aircraft parking aprons, taxiways and service buildings.

Once the new airport terminal gets operational, it is expected to triple the capacity of Kuwait’s airport to 25 million passengers a year.

|

|

Kuwait International Airport Terminal 2 ... the largest ongoing infrastructure project in the country. |

Kuwait’s civil aviation ministry had in June last year sought bids from six prequalified companies for the operation, maintenance and development of the international airport, including T2 and its affiliated aircraft aprons. These included GMR Airports (India), Fraport AG Frankfurt Airport Services Worldwide and Munich Airport International (Germany), Incheon International Airport Corporation (South Korea), TAV Airport Holding (Türkiye) and Daa International (Ireland).

Another key transportation sector project is the Mubarak Al Kabeer Port project, which is over 53 per cent complete, according to a report released last October by the GSSCPD. Last month, the country announced plans to allocate KD186 million to the Ministry of Public Works for the completion of the port project during the FY 2024-2025. The port, which covers a 11.6-sq-km area, will feature 24 berths and have a capacity of 8.1 million containers, according to Al Qabas.

The overall cost of developing the port has been put at KD990 million and will be completed through nine contracts. Work includes implementation of the road linking Subiya area to the east of Bubiyan Island; completion of the port dock and reclamation of the land as well as completion of the design of handling equipment and quay deepening.

Railway

Saudi Arabia and Kuwait have appointed France-based transport and mobility specialist Systra to conduct a feasibility study for a high-speed railway line linking their capitals. The feasibility study, to be funded equally by the two countries, is expected to be completed by mid-2024.

Kuwait is also reported to have issued a study and design tender for the first stage of the 565-km Kuwait Railway Project, which will link with the proposed GCC railway.

Housing

Among the largest projects that are being spearheaded by Kuwait’s Public Authority for Housing Welfare is the South Saad Al-Abdullah housing project. Leading construction group China Gezhouba Group Company (CGGC) has early this year broken ground on the key development located in the Jahra Governorate, about 25 km west of the capital city.

This follows the award of a KD345-million contract in late August last year by the PAHW to the Chinese company to conduct excavation and filling work as well as build more than 150 km of roads and bridges. The scope of work also includes laying of 975 km of pipelines.

The South Saad Al Abdullah housing project is being built at a total investment of KD2.1 billion, which will be phased over the coming state budgets. On completion, the project will cater to the housing needs of at least 150,000 people.

The project covers an area of nearly 64 sq km, comprising five residential sites with 24,508 houses.

Another major housing project under way is South Sabah Al-Ahmad City, a monumental project which will spread over an expansive 61.5 sq km. Leading multidisciplinary firm Pace is providing infrastructure supervision services for the project (see Page 30).

The PAHW is also planning to build 1,777 homes and public buildings as part of its Affordable Housing Project and is looking to appoint a consultant soon.

Power & Water

In line with the country’s goal to reach net-zero carbon emissions in 2060, the Kuwait Authority for Partnership Projects (KAPP) has invited bids from leading global and regional construction companies for the development of the third phase of Al Dibdibah Power and Al Shagaya Renewable Energy – Phase Three – Zone 1 Solar PV IPP – in collaboration with the Ministry of Electricity and Water and Renewable Energy.

The Al Dibdibah Power and Al Shagaya plant lies within the administrative boundary of Jahra Governorate approximately 100 km west of the capital. On completion, it will boast a net capacity of 1,100 MW.

Kuwait has set a target to boost its renewable energy production to about 4,500 MW by 2030, through the expansion of solar, wind and other energy projects,

Among other developments, five consortiums/companies are in the race for Az-Zour North Phase II and III and Al Khairan Phase One, two of Kuwait’s major independent water and power projects (IWPPs). KAPP stated that these include Taqa with consortium partners AH Al Sagar & Brothers and Jera Company; Acwa Power Company with Kuwait-based Gulf Investment Corporation; China Power International Holding with Malaysia-based Malakoff International and Saudi group Abdul Aziz Al Ajlan Sons and Company; Nebras Power, a Qatar-based power development company; and Sumitomo, a Japanese diversified company.

Az-Zour North IWPP will have a net capacity of at 2,700 MW of power and 120 million imperial gallon per day (MIGD) of desalinated water; Al Khairan IWPP will have a net capacity of at least 1,800 MW of power and 33 MIGD of water.

Among other developments in the sector, Mitsubishi Power, a power solutions brand of Mitsubishi Heavy Industries, has been awarded a long-term contract by the Kuwait Ministry of Electricity and Water and Renewable Energy to optimise the performance of the Sabiya power and water distillation station and boost its efficiency.

Oil & Gas

Given its oil-reliant economy, Kuwait intends to invest around $10 billion annually over the next five years in the oil sector, which would increase current production from 2.8 million barrels per day to 3.2 million barrels per day.

Meanwhile, in line with the global drive towards greener solutions, Kuwait National Petroleum Company has invited major engineering consulting companies to submit bids for a contract to conduct a preliminary feasibility study to determine how renewable energy and its alternatives can add value to the portfolio of the company and Kuwait Integrated Petroleum Industries Company (KIPIC). The projects also include carbon capture systems.

KIPIC has launched engineering, procurement and construction (EPC) tenders for a contract to deliver alternative feeding systems for the hydrogen production unit at the $16-billion Al-Zour Refinery.

Industrial Facilities

Kuwait’s Public Authority for Industry has plans to set up a $6.6-billion industrial zone in partnership with the private sector. The 6-sq-km Al-Naayem Industrial Zone aims to attract industrial capital in a bid to diversify the country’s oil-reliant economy.

The authority intends to appoint a consultant to carry out a feasibility study on the project which will be awarded on a BOT (build, operate, transfer) basis.

Another major proposed industrial project is the Al-Zour petrochemical complex: Kuwait Petroleum Corporation has revived plans to conduct feasibility studies for the planned $10-billion project.

Real Estate

The Markaz Real Estate Report for Kuwait forecasts a stable real estate market in the country in H1 2024. The report notes that the sector remained largely stable in 2023, with prices and rent holding steady and the normalisation of the pent-up post-pandemic demand. It also highlights the decline in residential sales, transaction volumes, commercial sector sales in the first three quarters of 2023.

- Prospects brighter

- Redefining urban landscape

- Iconic waterfront gets new look

- World’s first 3D printed tanks completed

- Kuwait projects at a glance