Volatility on the rise; how to manage risk

Amidst the most volatile global market conditions since Covid-19, HAITHAM KHADER* explores currency fluctuation risks in the construction industry and proposes a framework for regional companies to mitigate them.

01 September 2024

Construction is commonly known as a high-risk business; the risks and uncertainties associated with construction activities are usually higher and more dynamic than any other industry. Yet, an effective system of risk assessment and management within construction firms – and particularly in the region – is absent and remains one of the most challenging tasks for industry practitioners.

This part of the world usually takes the short-term view of risk, and alarm bells ring only when there is no budget allowance to accommodate that risk event.

In this region, where construction contracts are often priced in local currencies, international firms may face challenges if their accounting currency differs. Geopolitical tensions, high unemployment, and economic instability further complicate this issue, even for local companies dealing with international transactions, such as those related to procurement, financing, and insurance.

Given the instability of the global economy and recent market crashes, the highly competitive market environment, tighter margins and extended payment terms in contracts, exchange rate movements are becoming increasingly crucial to the performance of contracting parties.

Currency Fluctuations

Following the 1973 collapse of the Bretton Woods agreement which, to a certain extent, maintained stable currency rates by linking leading currencies to gold reserves, businesses and financial institutions have been severely impacted by changes in exchange rates. The impact of “appreciation” – an increase in value – or “depreciation” – a fall in value – of one currency relative to another is known as the Foreign Exchange (Forex) risk.

|

|

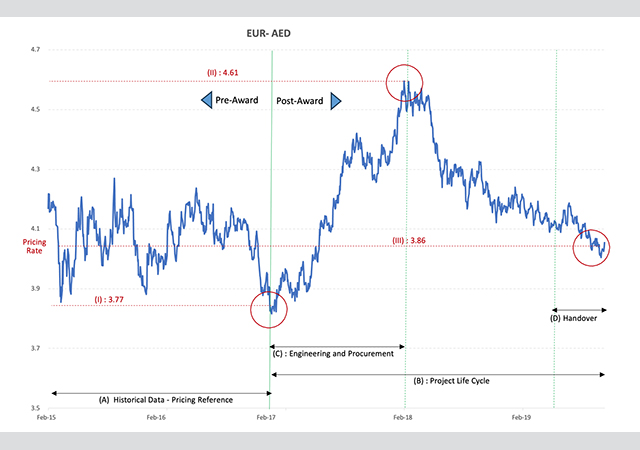

Figure 1: Euro-AED Exchange Rate Fluctuation (2015-2019). |

Unexpected or extreme events may severely impact the budget or cash flow, make it more difficult for a business to fulfil its obligations, cause performance disruptions, and may even lead to liquidation. A prominent example of such a scenario was the 1999 collapse of Carillion, a major UK construction company.

In a 2019 case study, for instance, a European company awarded a UAE project faced significant profitability issues when the euro depreciated by 22 per cent during the procurement phase (see Figure 1). Payments by the client were made in AED, while expenses were mostly transacted in euros. Due to insufficient attention to the extended payment terms set in the head contract, currency fluctuations and lacking hedging strategies, the company cited this as the main reason for closing its regional business unit in 2021, underscoring the critical need to manage Forex risk, especially when dealing in the other more volatile currencies in the region.

|

|

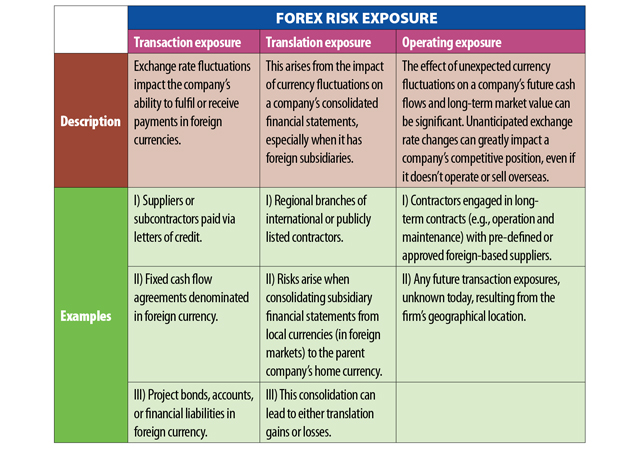

Figure 2: Types of Forex risk exposures in construction. |

Forex Risk Exposure

Generally, the more construction firms expand their operations internationally, the more they encounter challenges related to Forex risk. Figure 2 outlines the three types of foreign exchange exposure construction firms may typically face.

Driving Factors

Within the industry’s context and under regional circumstances, several factors contribute to companies being exposed to such risks. The main ones investigated are:

External factors

• Political instability: Since 2010, political instability in the Middle East has led to worsening macroeconomic conditions and a slow recovery, adversely impacting currency stability, trade and the viability of the construction business. Recent conflicts are further exacerbating the situation.

• Economic downturn: Economists argue that the global economy hasn’t fully recovered from the 2008 recession and Covid pandemic consequences and will probably remain unpredictable for the next few years. This apart, the oil price instability has undermined confidence in short-term economic recovery, negatively affecting exchange rates with more stable currencies.

Internal factors

• Lack of knowledge and expertise: Although many construction industry leaders claim awareness of risks management, reports reveal that project managers often lack the financial expertise to identify and manage them effectively. A significant issue with Forex risk is that construction leaders often delegate it to finance teams, who may have the knowledge but are not involved in decision-making.

• Lack of risk management structure: With over 20 years of experience, I can say that most regional construction lacks a systematic approach, vision, and crucial knowledge in risk management. Typically, risks are addressed through cost or schedule adjustments and lessons learned from past projects, rather than thorough risk assessment and impact analysis. Implementing a benchmarking risk management framework could help organisations in the region better manage various risks, including Forex risk.

• Contractual governance: Many clients in the region tend to impose rigid contract terms on contractors or suppliers. Given the region’s reputation for lacking best management practices and having a less-flexible organisational culture, an increasing number of experts are calling to implement more flexibility in contracts to address risks beyond contractors’ or suppliers’ control, such as Forex risk.

Managing Forex Risk

A risk management plan must be put in place following the assessment of Forex risk and its potential exposure, as discussed above. Mitigation plans should be developed methodically, including the context establishment, identification, analysis, and evaluation of risks to determine the best course of action and ownership assignment. Under the leadership of the project management office (PMO), usually, the Forex treatment strategy is advised to involve setting up a communication and strategic framework across the parties mentioned below throughout the project lifecycle, both pre- and post-award.

Estimation/Proposals

One of the most critical errors is that estimators often use current exchange rates for regional tenders without considering any long-term outlook. Estimators should review exchange rates over a longer period and, if significant fluctuations or potential signals in the economic or political landscape are observed, they should consult with the finance and commercial teams, and, when necessary, escalate the matter to top management or the client.

Contracts/Commercial

The most common type of contracts utilised in the region is the fixed/lump-sum contract, with local versions often lacking terms for currency adjustments or typically omitting standard provisions in international contracts forms (for example, FIDIC, NEC, JCT). If the PMO or contract department identifies that a tender or project involves payments in a highly volatile currency, it is advisable to negotiate and include provisions during contract formation to reserve the rights of parties against significant currency fluctuations.

Procurement

The procurement team often requests quotes (RFQs) from suppliers without considering the pricing currency strategy, and this oversight continues even after purchase orders or agreements are being negotiated. In this instance, it is advised that, to the extent feasible:

• To provide an accurate cost performance projection against the budget, procurement to raise RFQ in the same currency as the project payment/contract;

• For public companies, to use the currency of the company’s main account or the most favourable one;

• Under finance or credit bank advice, request quotations in the most stable currency, such as USD.

Finance

By now, it should be obvious that finance has the largest influence over Forex risk management. For large or complex projects, hedging strategies with spot or forward contracts can effectively mitigate Forex risk by fixing currency rates. These contracts, issued typically by financial institutions or banks, protect against negative currency fluctuations.

It is worth noting out that although this method is the safest way to shield businesses from Forex risk, it is typically expensive, and, therefore, discourages construction companies from utilising it. Such expenses may raise bid prices or potentially decrease project profits, if added to the budget during execution. Additionally, the issuer of such contracts receives no positive realisation in relation to favourable exchange rates.

Clients/Owners

As I usually say, a project’s success relies heavily on the clients’ ability to support their contractors and keep their commitments. Because of what I perceive to be unbalanced contract terms, there are a lot of tense client-contractor relationships and conflicts in the region. When it comes to such beyond control risk, this environment impedes effective communication and problem-solving, especially with a lack of a mature risk management philosophy. Effective communication and well-balanced relationships, including contracts, increase the likelihood that projects will succeed.

Final Thoughts

Recently, I’ve had many colleagues ask about the impact of the recent financial market crashes on our business. While the long-term effects, such as economic downturns, reduced spending and higher unemployment, are well understood, an immediate concern that could impact the viability of ongoing operations is currency fluctuation. Regional construction leaders should address Forex risk, understand its potential implications, and implement effective mitigation strategies within their business units.

*Haitham Khader |MBA, MLSCM, CCCM, PMP, RMP, CCP, PSP, ACP, BGS is a Director PMO in a German company in Frankfurt, and has over 20 years of diverse experience working for leading organisations in both the Middle East and Europe.