Speed kills: Projects paying the price

The speed at which projects are expected to be completed in the Middle East is becoming a major “mega-disrupter” that affects over half of all capital projects and costs the industry millions, states HKA’s latest Crux Insight Report, which reveals how the drive to fast-track projects is causing delays and disputes across the region.

01 November 2024

The Middle East is facing the significant impact of rushing projects, with the pursuit of speed at all costs having affected over half of all capital projects in the Middle East, according to the latest report by HKA, the global consultancy specialising in risk mitigation, dispute resolution, expert witness and litigation services.

Its Seventh Annual Crux Insight Report, Changing the Narrative, reveals the scale of disruption and financial damage done to engineering and construction projects globally and the clusters of interrelated causes driving claims and disputes.

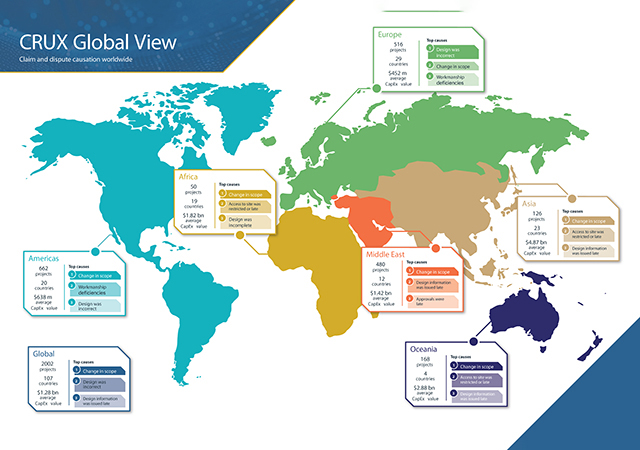

For the latest Crux analysis, 2,002 projects across 107 countries with a total value of $2.254 trillion were analysed. The report revealed that Middle Eastern projects were significantly delayed, with claims for time extensions averaging a staggering 80.9 per cent of planned schedules. This figure represents the highest worldwide, surpassing the global average of 66.5 per cent.

Moreover, the mega-disrupter of “speed to build” – clustered issues arising from the imperative to save time and design costs – impacted more than one in two (52.9 per cent) projects in the Middle East.

“The time-proven mantra of HKA advisory experts is ‘Go slow to go fast’,” Jad Chouman, Partner, Head of Middle East, HKA advises. “Crux Insight’s fundamental lesson from our analysis of hundreds of distressed projects across all sectors worldwide is that programmes that prioritise speeding the build are likely to be overtaken by disruptive and costly events. This Crux report not only charts these and other risks, it points the way to better, more certain outcomes in our region.”

Key findings on projects globally include:

• Disputed costs averaged $83.1 million – just under a third (33.2 per cent) of capital expenditure;

• Time overruns would add almost 16 months or two-thirds (66.5 per cent) to a typical schedule;

• The total value of sums in dispute on the projects analysed was $84.44 billion, while the cumulative length of time extensions was close to a millennium (994 years);

• Five “mega-disrupters” – conflicts and disputes over contracts, behaviours, speed to build, skills and the environment – each affected 40-50 per cent of the projects worldwide.

|

|

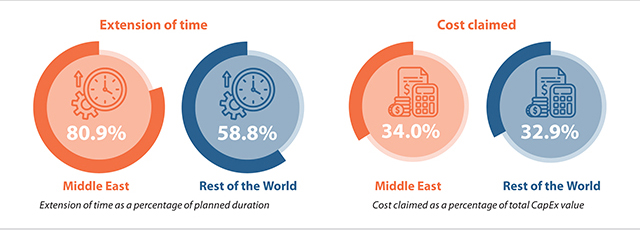

Extension of time and costs claimed: a comparison of the region Vs the rest of the world. |

A damaging pattern

In the years following the global pandemic, heightened geo-political uncertainties and economic shocks have distorted the myriad pressures and challenges project stakeholders face. Yet the most prevalent causes of claims and disputes are recurrent, stemming from repeated, deep-rooted, underlying failures – a damaging pattern the capital projects and infrastructure sector needs to break, stated the report.

On average globally, projects claimed extensions of time to prolong works by an additional two-thirds (66.5 per cent), of their planned schedules, while disputed costs averaged very nearly a third of budgeted CapEx (33.2 per cent).

‘Mega-disrupters’

While Crux demonstrates variations in the pattern of claims and disputes between regions and project types, the analysis also confirms that the same deep-rooted problems recur across the years, sectors and borders.

These mega-disrupters each affected 40 to 50 per cent of the 2,002 projects worldwide in the Crux analysis, with regional variations:

• Contract: Conflicts over the formation or terms of a contract – from administrative shortcomings to spurious claims and tender errors – affected 43.2 per cent of projects worldwide, rising to 51.9 per cent in the Middle East and 68.0 per cent in Africa. While cost inflation may have eased, economic shocks continue to reverberate through long-term projects. Under financial pressure, contract administrators may resort to alternative ways of recovering costs, leading to clashes over the interpretation of clauses, alleged variations, and unsubstantiated claims.

• Behaviours: Half of all projects worldwide (49.7 per cent) had claims and disputes related to individual and team behaviours that permeate every aspect of the construction process. Causes heavily influenced by behaviours peaked at 67.3 per cent in the Middle East, and hovered around 60 per cent in Africa, Asia and Oceania. The averages for Europe and the Americas, were closer to 40 per cent. Monetary pressures drive unreasonable behaviours, as do ingrained ways of working, especially in an unfamiliar context – whether a country, project type, or form of contract.

• Speed to build: Affecting 47.6 per cent of all projects worldwide, this design-centric cluster (covering late, incomplete or incorrect design as well as late subcontractor/supplier appointments and unrealistic targets) is driven in large part by the twin imperatives to ‘speed the build’ and save on up-front time and costs. Rushing or overlapping design development with construction in the hope of achieving the earliest possible completion inevitably leads to more design changes, delays and disputes as projects progress.

• Skills: Just under half of all projects (49.7 per cent) worldwide had claims and disputes largely attributable to gaps in skillsets and experience. Ageing workforces, lack of investment in human capital, and failure to attract young talent are contributory factors. The effects are evident from design offices to operational performance on site – and particularly noticeable in Europe (57.8 per cent) and the Americas (51.5 per cent), which suffered from higher levels of poor workmanship. In the UK, such defects were a factor in 26.0 per cent of claims or disputes, compared to 14.8 per cent worldwide.

• Environment: Exceptionally adverse weather was to blame for a relatively small proportion of claims and disputes, peaking at 13.3 per cent in the Americas. But other factors with a strong environmental element (such as unforeseen ground conditions) pushed the total to 41.3 per cent worldwide. More projects were impacted in Africa (56.0 per cent), the Middle East (49.0 per cent) and Asia (48.4 per cent).

Just as ominous for the industry, diverse environmental risks – from failure to design for resilience and emerging contaminants to concerns over corporate governance and biodiversity – are driving claims and litigation amid increasing scrutiny and regulation.

|

|

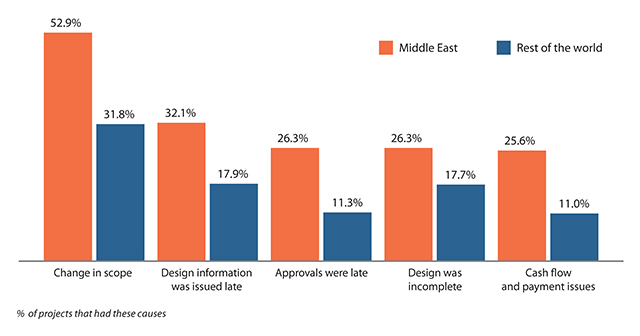

Top causes of claims/disputes: a comparison of the Middle East Vs the rest of the world. |

Significantly behind schedule

The Middle East contributed 480 projects to the Crux analysis and a combined Capex of $626 billion.

Sums in dispute amounted to 34.0 per cent of budgeted costs – broadly in line with the global average of 33.2 per cent – and equated to $132 million per project. However, claimed extensions of time (EOT) averaged out at 80.9 per cent of planned duration – significantly higher than the global EOT benchmark (66.5 per cent) – adding an extra 19 months to the typical schedule.

The ‘speed to build’ mega-disrupter delaying projects

Such overruns occur despite – or partly, because of – pressures to speed the start and completion of works. The Crux analysis reveals that speed to build impacted more than half (52.9 per cent) of projects in the region, higher than the global average (49.7 per cent).

This cluster of causes underlying claims and disputes includes issues ranging from scope change to unrealistic targets. One factor alone, late design information, impacted a third (32.1 per cent) of projects in the Middle East – far higher than the rest of the world (17.9 per cent).

Incomplete design disrupted over a fifth (26.3 per cent versus 17.7 per cent elsewhere), although the Middle East had a somewhat lower incidence of design errors (17.9 per cent versus 22.6 per cent). One in 10 (10.8 per cent) Middle East projects also suffered claims or disputes related to unrealistic targets or expectations.

‘Go slow to go fast’

Successive Crux reports have revealed the prevalence of design-related failures on distressed capital projects worldwide.

The common factor in many of these projects is the desire to speed the build and reduce up-front costs – usually by truncating the design phase to start work as early as possible on site, with design development overlapping procurement and construction, to accelerate progress and achieve early completion.

In oil, gas and industrial process projects, the overriding motivation is to complete the asset and start production, as the value of the revenue stream is often so great that cost overruns can be considered secondary. Yet schedule overruns globally still extended programmes by around two-thirds in both the resources and energy (64 per cent) and industrial plant sectors (69 per cent).

Industrial, oil and gas, and energy projects often lack sufficient time for a comprehensive design phase. Additionally, there may be a failure to verify the front-end engineering design against an oil company’s engineering standards and performance obligations, necessitating later design adjustments to meet these standards.

Design is about decision-making: the more decisions made post-contract, the greater the risk of error and disputes over liability. The earlier a mature and resolved design is frozen, the fewer delays are likely to be encountered through the course of a programme, and the greater the chance it will be delivered on cost, on schedule, and with the benefits envisaged in the original business case.

“The time-proven mantra of HKA advisory experts is ‘Go slow to go fast’,” Jad Chouman, Partner, Head of Middle East, HKA advises. “Crux Insight’s fundamental lesson from our analysis of hundreds of distressed projects across all sectors worldwide is that programmes that prioritise speeding the build are likely to be overtaken by disruptive and costly events. This Crux report not only charts these and other risks, it points the way to better, more certain outcomes in our region.”

Haroon Niazi, HKA Partner and Construction, Claims and Expert Services Lead, adds: “Investing more time and money up-front may mean sacrificing some early progress, but for an ultimately better result. Early contractor involvement can help stress-test designs and schedules. The shift we are seeing from transactional approaches to relationship-based contracting will be hugely beneficial if complemented by careful planning, phasing and packaging of large projects, tailored commercial models, and the necessary project delivery expertise. We urge all industry stakeholders to consider our Crux findings and recommendations.”

*Crux is the ongoing research programme of HKA, a global consultancy specialising in risk mitigation, dispute resolution, expert witness and litigation services. Data on a total of 2,002 projects has now been captured within this unique database, which draws on the first-hand investigations of HKA consultants.