Mega-projects such as The Red Sea Project are boosting façade demand by prioritising modular and prefabricated systems for cost and time efficiency.

Saudi façade market set for 7.3pc growth on green construction push

Saudi Arabia’s façade sector is poised for sustained expansion as government initiatives, giga-project ambitions, and demand for green construction continue to shape market dynamics, according to an industry report.

01 December 2025

Saudi Arabia’s building façades market is projected to grow at a compound annual rate of 7.3 per cent between 2025 and 2033 as the kingdom’s Vision 2030 sustainability goals drive construction demand, according to new industry research.

Government initiatives, including the Saudi Green Initiative and stricter energy codes, are fuelling demand for energy-efficient façade systems amid a nationwide surge in green building activity. The kingdom leads the region with 2,000 out of 5,000 ongoing green projects, and its green building sector is forecast to reach $33 billion by 2030 – double the value in 2024, according to a report by IMARC Group.

Corporate initiatives, such as Aramco’s $1.5 billion sustainability fund and a new memorandum with the Saudi Contractors Authority, reinforce trends toward investment in eco-friendly construction and workforce training.

Progressive regulations and codes under the Saudi Green Initiative continue to shape market demand toward intelligent, high-performance building envelopes.

|

|

Source: Imarc |

The market is responding to these dynamics with increased adoption of advanced façade solutions such as double-glazed glass, photovoltaic panels, and dynamic shading, targeting reduced energy consumption in a climate marked by extreme heat. Manufacturers are also investing in high-performance products like low-emissivity glass and thermally broken aluminium frames to minimise cooling needs. International and local suppliers are scaling up their prefabrication capabilities in response to digitalisation and industrialisation trends, making modular systems a dominant force in the market.

Mega-projects are further boosting façade demand by prioritising modular and prefabricated systems for cost and time efficiency. Prefabrication is gaining traction due to benefits including faster installation, reduced material waste, and improved quality control, particularly for tight project schedules.

“Prefabricated and modular façades are quickly becoming the norm as Saudi Arabia accelerates urbanisation and giga-projects,” the report stated, citing the growth of off-site manufacturing and digital construction practices that enable custom engineering for complex, high-rise structures.

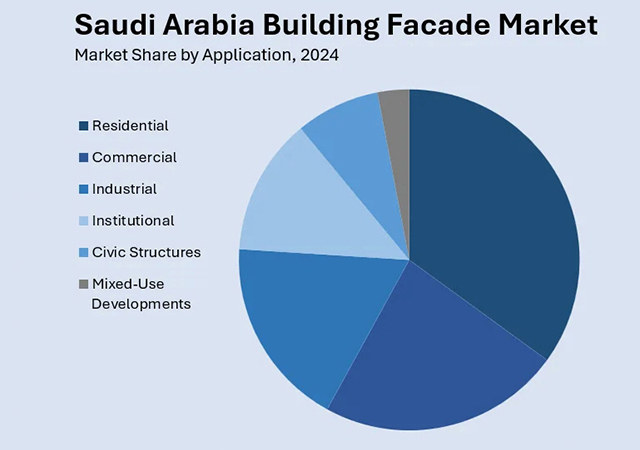

The report profiles the market by material, product type, application, and regional segment, with glass, metal, and composite materials accounting for significant share. The regional analysis covers Northern and Central, Western, Eastern, and Southern areas, reflecting broad-based market opportunities. Key end users include architects, construction companies, real estate developers, building owners, and government agencies.

The market’s competitive landscape is evolving, with both Saudi and international suppliers expanding their prefabrication capabilities to meet surging demand, alongside investments in green technology and workforce training, such as Saudi Aramco’s $1.5 billion sustainability fund.

As urban growth accelerates and sustainability becomes a central pillar of Saudi construction, analysts expect the building façade sector to remain a focal point for innovation and investment over the coming decade.

- Balancing safety, performance in building envelopes

- Façade Solutions champions COR-TEN for green projects

- Saudi façade market set for 7.3pc growth on green construction push

- Leveraging acoustic design to achieve quiet comfort