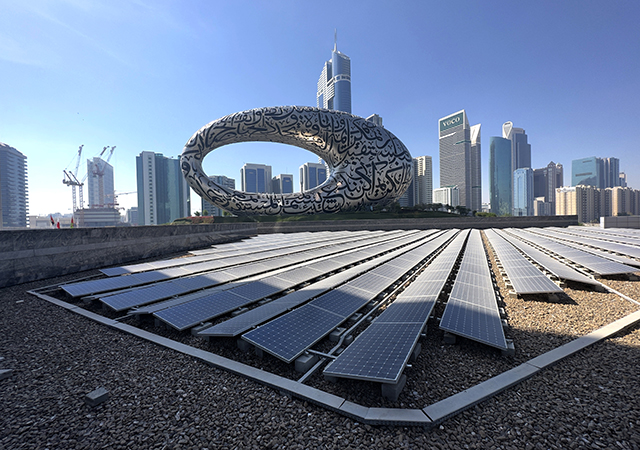

Distributed, city-based installations can monetise unused roof space and directly power urban developments.

Study puts spotlight on 200 sq km of solar potential in Riyadh, Abu Dhabi

A new study by Knight Frank highlights a major investment opportunity in Riyadh and Abu Dhabi, identifying 201 sq km of commercial and industrial rooftop space suitable for distributed solar power.

01 January 2026

A major new study by global real estate consultancy Knight Frank, produced in collaboration with the University of Leeds and the University of Bristol, has identified vast, untapped rooftop solar capacity in key Gulf cities, suggesting a commercially viable shift from desert-based mega solar park projects to distributed urban installations.

The report, titled Going Green: Rooftop Solar Potential in the GCC, concludes that rooftop photovoltaic (PV) systems, particularly on large commercial and industrial buildings, are no longer a “peripheral technology” but are capable of becoming a “central element” of the region’s future energy planning. This decentralised approach is seen as crucial for helping nations like Saudi Arabia (net-zero by 2060) and the UAE (net-zero by 2050) meet their ambitious carbon reduction goals.

Using advanced geospatial modelling, the research provided a detailed inventory of potential solar capacity in Riyadh and Abu Dhabi.

The findings signal the beginning of a “second renewable energy revolution” in the Gulf, shifting focus from utility-scale success stories to distributed, city-based installations that monetise unused roof space and directly power urban developments. Currently, rooftop solar contributes less than one per cent of the total installed solar capacity in the UAE and Saudi Arabia.

|

|

|

Faisal Durrani, Partner, Head of Research, MENA, says: “With the built environment responsible for 39 per cent of global carbon emissions, according to the World Green Building Council, and rapid real estate expansion projected across the Gulf through 2040, our whitepaper highlights an opportunity for developers, investors and governments to monetise vast tracts of unused urban roof space.

“The findings demonstrate that distributed rooftop solar is no longer a peripheral technology but is capable of becoming a central element of regional energy planning – delivering long-term energy cost stability, grid resilience and investment-grade carbon reduction.

“To put this into perspective, in Riyadh we have been able to identify 158.2 sq m of potential rooftop space that could be used for solar installations, while in Abu Dhabi the figure stands at 42.8 sq m.”

SUPPORTING SAUDI ARABIA’S NET ZERO AGENDA

In Saudi Arabia, where the government has set a target of achieving net zero carbon emissions by 2060 and a 50 per cent renewable energy mix by 2030, the solar infrastructure has expanded significantly over the past five years, supported by government tenders and increasing private sector participation.

Across the country, utility-scale projects such as Sakaka (300 MW), Sudair (1,500 MW) and Al Shuaibah (2,600 MW) have established benchmarks for cost-competitive solar power that are among the lowest in the world, with a levellised cost of energy (LCOE) of 6-9 halalas/kWh.

Wesley Thomson, Partner, Head of ESG, MENA, says: “Although distributed solar remains a nascent market, commercial and industrial installations have begun to emerge in industrial zones, logistics parks and new developments in Riyadh, Dammam and Jeddah, reflecting growing interest in energy diversification and cost efficiency, as well as rising demand from commercial occupiers for ‘green’ assets.”

|

|

|

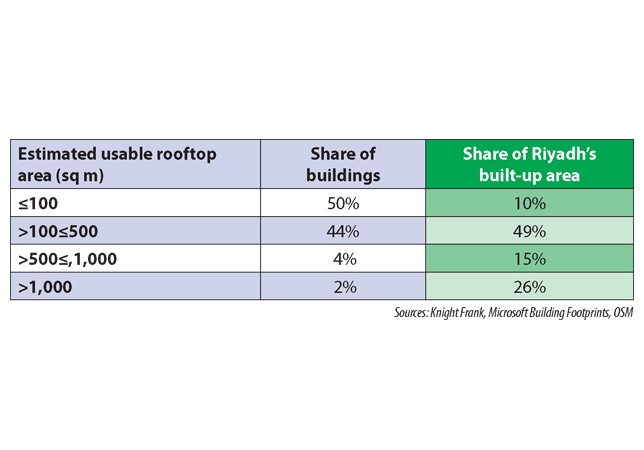

The research team assessed approximately 870,000 buildings across Riyadh, identifying a total of 158.2 sq m of technically usable rooftop area. While half of Riyadh’s buildings have small rooftops offering limited capacity, large buildings with more than 1,000 sq m of usable space account for 26 per cent of the city’s total roof area.

The report states that if all large rooftops (more than 1,000 sq m) in Riyadh were fully utilised using single-axis solar tracking systems, the city could generate 17,500 GWh of electricity annually. This equates to 40.7 per cent of Riyadh’s total annual electricity consumption, based on 2023 usage data.

Thomson adds: “We are seeing a clear pathway where distributed solar becomes a central pillar of the kingdom’s energy strategy. This is not theoretical; the economics are compelling today. Using data from the kingdom’s Shamsi Solar Calculator, we estimate that rooftop photovoltaic systems in Riyadh now offer a payback period of just seven to 11 years. Industrial and logistics assets are particularly well suited for this transition, with larger commercial installations achieving payback in as little as seven years due to economies of scale.”

UNTAPPED POTENTIAL IN THE UAE

The UAE has committed to becoming a global clean energy leader, targeting 50 per cent of electricity generation from clean sources by 2050 and a 70 per cent reduction in carbon emissions as part of the UAE Energy Strategy 2050. Major progress to date has come from utility-scale solar projects, such as the Mohammed Bin Rashid Al Maktoum Solar Park in Dubai, with rooftop solar contributing less than one per cent of installed solar power capacity.

Knight Frank’s geospatial audit of Abu Dhabi identified 42.8 sq m of usable rooftop space – an area equivalent to more than 6,000 football pitches. Utilising this space would effectively create a distributed solar power plant equivalent to 55.5 per cent of the land area occupied by the Mohammed Bin Rashid Solar Park, but would, in theory, be located directly at the source of consumption.

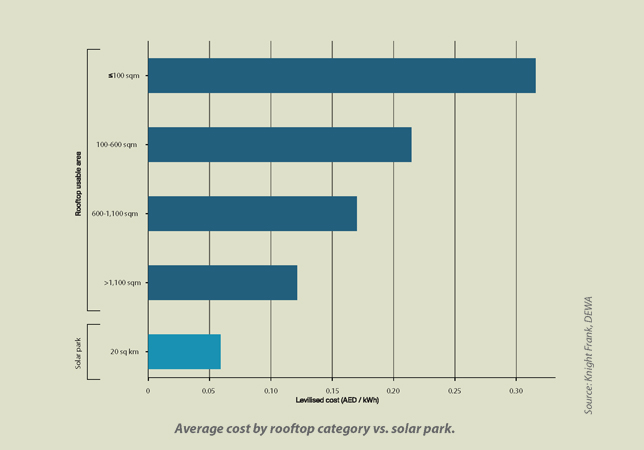

Knight Frank’s research also indicates that large-scale rooftop installations are closing the price gap with desert-based solar farms, which have made headlines for delivering some of the lowest energy tariffs in the world. In Abu Dhabi, for instance, rooftop systems larger than 10,000 sq m can deliver a LCOE as low as 8 fils/kWh. This figure is only marginally higher than the tariffs of around 6 fils/kWh achieved by gigawatt-scale solar parks in the desert, but without the associated land costs.

Thomson comments: “Large-scale rooftop systems deliver utility-scale cost competitiveness without the land and complexities of developing and maintaining solar parks in remote locations. In effect, these are investment-grade solar assets ready for deployment today.”

|

Solar Trees at the Expo 2020 Dubai site generate power where it is consumed, reducing grid strain and utilising existing urban footprints. |

SCALE IS KEY

A consistent finding across both Riyadh and Abu Dhabi is that system scale is the decisive factor in achieving cost competitiveness, transforming rooftops into “investment-grade solar assets”.

In Abu Dhabi, smaller residential systems (less than 100 sq m) produced energy at around 30 fils/kWh. However, when deployed on rooftops greater than 1,100 sq m, this cost fell by nearly 60 per cent to around 13 fils/kWh. The largest industrial roofs pushed this down further to 8 fils/kWh.

Similarly, in Riyadh, moving from a small residential set-up to a large commercial installation reduced the payback period by several years. This “size-to-value” correlation sends a strong signal to owners of warehouses, malls, industrial parks and government buildings that their roofs have the potential to become revenue-generating assets.

While the region’s gigawatt solar parks continue to lead the world in terms of efficiency and output, distributed urban solar generation offers its own unique benefits that can be harnessed to achieve net zero targets, the report points out. Generating power where it is consumed reduces the strain on transmission networks and eases peak load pressures, improving grid resilience. It also requires no new land allocation, which is a major cost in traditional solar farms. And, with the built environment contributing significantly to global emissions, on-site generation is the most direct method for landlords to reduce the carbon intensity of their portfolios.

Dr Christopher Payne, Partner, Strategy, Economics and Geospatial, MENA, says: “Our analysis suggests that the GCC is transitioning from a phase of utility-scale success to distributed opportunity. Projects such as Noor Abu Dhabi, Sakaka and Sudair have proved the viability of solar in the desert, but the cities present a huge opportunity for the next phase of decarbonisation.

“As the UAE and Saudi Arabia continue their rapid urban expansion to accommodate growing populations, the energy demands of their cities will only increase. The solution to meeting this demand lies, in part, directly overhead. By enabling rooftop solar at scale, GCC nations can create a new class of sustainable infrastructure assets that attract international institutional investment, support corporate environmental and sustainability goals, and secure a low-carbon future for the region.”

- Study puts spotlight on 200 sq km of solar potential in Riyadh, Abu Dhabi

- Renolit route to highly visible slip-resistant roof access