IHC 9-month profit surges 236% to $6.53 billion

ABU DHABI, November 8, 2022

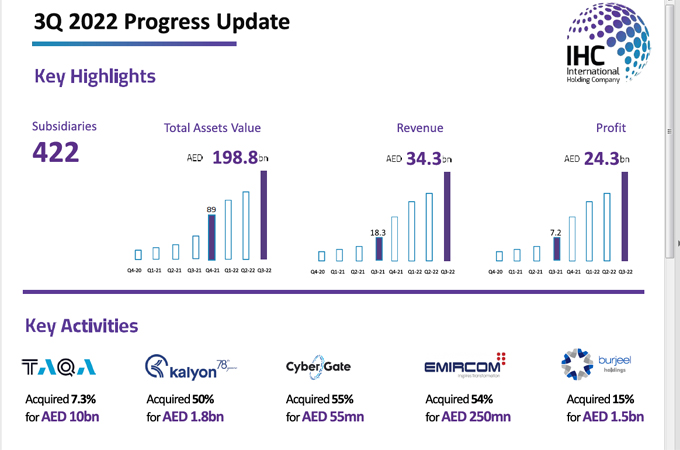

International Holding Company (IHC), one of the largest corporate investment holding firms in the Middle East and Africa, headquartered in Abu Dhabi, reported 236% surge in profit for the 9-month period to AED24 billion ($6.53 billion), compared to the same period last year.

The profit also surpassed its full-year original profit forecast of AED17 billion, the company said.

Continued momentum in strategic direct and indirect acquisitions, locally and internationally, were the main drivers behind the growth rate above the previous year's quarter, with the company's total assets increasing to AED198.8 billion from AED64.4 billion in Q3 2021.

“This is an outstanding result of which we can all be proud. It reflects the strength that IHC has developed in recent years. Our team's discipline, continuity, and its irrepressible will to move our organization forward are truly impressive,“ said Syed Basar Shueb, IHC’s Chief Executive Officer.

IHC’s current assets, comprising its subsidiaries, have grown by 138% as of September 30, 2022 compared to December 31, 2021.

The key contributors to the total current assets include Alpha Dhabi Holding, Q Holding, International Securities, Al Seer Marine and Multiply Group. Total cash and bank balances was AED31.80 billion in Q3 2022 against AED20.25 billion in 2021.

IHC revenues climbed to AED34.3 billion, an increase of 87% as the company emerged stronger in the present competitive business climate compared to AED18.3 billion in the prior year third quarter. The rise in quarterly revenues was driven by sustained demand across all business activities and strategic acquisitions over the past 12 months, including Aldar Properties, Arena Events Limited, Yas Clinic, Abu Dhabi Stem Cells Center, Reem Investments, Abu Dhabi Vegetable Oil Company (Advoc), Ras Al Khaimah Cement Investment (RAKCIC), Emircom and Cyber Gate Defense.

While IHC subsidiaries are set for an aggressive growth plan in Q4, the solid nine-month business performance of the subsidiaries this year reflected positively on the company’s Q3 results, the company said.

IHC’s top five revenue contributors include Energy, Food Sector, Healthcare, Real Estate and Utilities for the nine months period ended September 30, 2022, followed by other business verticals of the group in the private domain.

Leading the Acquisition Market

International Holding Company has increased its M&A activity, including in India and Turkey. The company’s acquisition total value in Q3 2022 crossed AED13.5 billion, which included the AED10 billion TAQA deal, AED1.8 billion in Kalyon Enerji and AED1.5 billion in Burjeel Holding, and AED250 million in Emircom while aiming for publicly listing more of its companies on ADX growth markets. IHC will continue seeking sizeable acquisitions in Q4 to boost its bottom line, it said. - TradeArabia News Service