GCC banks' energy transition exposure on stable ground: report

DUBAI, March 13, 2023

Gulf Cooperation Council (GCC) banks' exposure to sectors most subject to energy transition risks has remained broadly stable over the past three years, said an S&P Global Ratings report.

However, the effect of energy transition on oil and gas prices and investor and customer appetite for finance will influence GCC banks' long-term creditworthiness, says the report titled "The Energy Transition: GCC Banks On Stable Ground," published on Monday.

Since the agency first published a report on GCC banks' exposure to energy transition three years ago, their exposure to sectors most subject to energy transition risks has remained broadly the same, it said.

Energy transition refers to the global energy sector's shift from fossil-based systems of energy production and consumption--including oil, natural gas, and coal--to renewable energy sources like wind and solar.

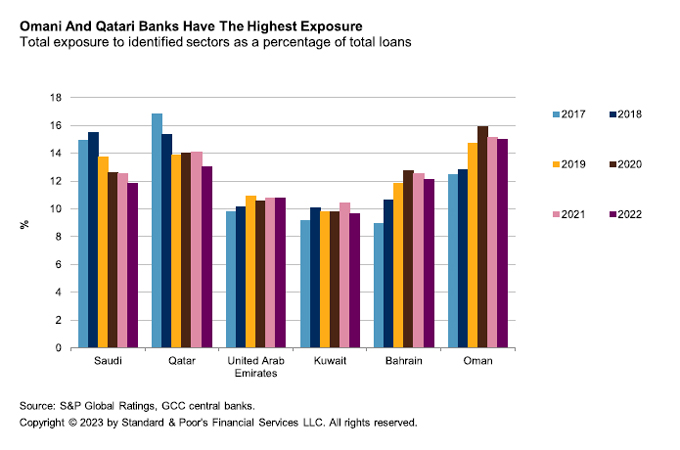

Exposure to these sectors was around 12% of total lending on average at year-end 2022.

"Our findings show Omani and Qatari banks are most exposed, while the United Arab Emirates (UAE) and Kuwaiti banks have marginally lower concentrations," it said.

Meanwhile, economic diversification and GCC banks' sustainability strategies create opportunities to expand sustainable financings, but dependence on oil and gas remains high, the report added. - TradeArabia News Service