Global growth to slow to 2.4% this year: World Bank

WASHINGTON, January 10, 2024

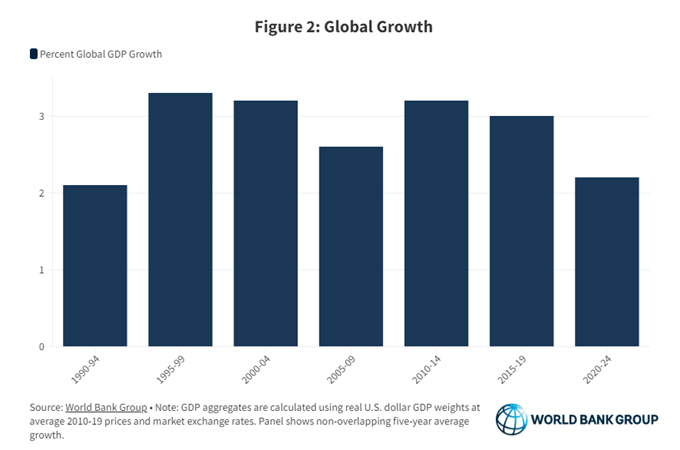

Global growth is expected to slow to 2.4 percent in 2024 -- the third consecutive year of deceleration -- reflecting the lagged and ongoing effects of tight monetary policies to rein in decades-high inflation, restrictive credit conditions, and anemic global trade and investment, according to a World Bank report.

Near-term prospects are diverging, with subdued growth in major economies alongside improving conditions in emerging market and developing economies (EMDEs) with solid fundamentals, said the World Bank's Global Economic Prospects report.

Meanwhile, the outlook for EMDEs with pronounced vulnerabilities remains precarious amid elevated debt and financing costs.

Downside risks to the outlook predominate, it said. The recent conflict in the Middle East, coming on top of the Russian Federation’s invasion of Ukraine, has heightened geopolitical risks. Conflict escalation could lead to surging energy prices, with broader implications for global activity and inflation. Other risks include financial stress related to elevated real interest rates, persistent inflation, weaker-than-expected growth in China, further trade fragmentation, and climate change-related disasters, the report highlighted.

Against this backdrop, policy makers face enormous challenges and difficult trade-offs. International cooperation needs to be strengthened to provide debt relief, especially for the poorest countries; tackle climate change and foster the energy transition; facilitate trade flows; and alleviate food insecurity, it said.

EMDE central banks need to ensure that inflation expectations remain well anchored and that financial systems are resilient. Elevated public debt and borrowing costs limit fiscal space and pose significant challenges to EMDEs -- particularly those with weak credit ratings -- seeking to improve fiscal sustainability while meeting investment needs, the report suggested.

Commodity exporters face the additional challenge of coping with commodity price fluctuations, underscoring the need for strong policy frameworks. To boost longer-term growth, structural reforms are needed to accelerate investment, improve productivity growth, and close gender gaps in labor markets.

Regional prospects

Although some improvements in growth are expected in most EMDE regions, the overall outlook remains subdued.

Growth this year is projected to soften in East Asia and Pacific -- mainly on account of slower growth in China -- Europe and Central Asia, and South Asia. Only a slight improvement in growth, from a weak base in 2023, is expected for Latin America and the Caribbean.

More marked pickups in growth are projected for the Middle East and North Africa, supported by increased oil production, and Sub-Saharan Africa, reflecting recovery from recent weakness. In 2025, growth is projected to strengthen in most regions as the global recovery firms.

Magic of Investment Accelerations

Investment powers economic growth, helps drive down poverty, and will be indispensable for tackling climate change and achieving other key development goals in emerging market and developing economies (EMDEs).

Without further policy action, investment growth in these economies is likely to remain tepid for the remainder of this decade. But it can be boosted.

The report offers the first comprehensive analysis of investment accelerations -- periods in which there is a sustained increase in investment growth to a relatively rapid rate -- in EMDEs. During these episodes over the past seven decades, investment growth typically jumped to more than 10 percent per year, which is more than three times the growth rate in other (non-acceleration) years.

Countries that had investment accelerations often reaped an economic windfall: output growth increased by about 2 percentage points and productivity growth increased by 1.3 percentage points per year. Other benefits also materialised in the majority of such episodes: inflation fell, fiscal and external balances improved, and the national poverty rate declined.

Most accelerations followed, or were accompanied by, policy shifts intended to improve macroeconomic stability, structural reforms, or both. These policy actions were particularly conducive to sparking investment accelerations when combined with wellfunctioning institutions. A benign external environment also played a crucial role in catalysing investment accelerations in many cases.

Fiscal Policy in Commodity Exporters

Fiscal policy has been about 30 percent more procyclical and about 40 percent more volatile in commodity-exporting emerging market and developing economies (EMDEs) than in other EMDEs. Both procyclicality and volatility of fiscal policy -- which share some underlying drivers -- hurt economic growth because they amplify business cycles. Structural policies, including exchange rate flexibility and the easing of restrictions on international financial transactions, can help reduce both fiscal procyclicality and fiscal volatility. By adopting average advanced-economy policies regarding exchange rate regimes, restrictions on crossborder financial flows, and the use of fiscal rules, commodity-exporting EMDEs can increase their GDP per capita growth by about 1 percentage point every four to five years through the reduction in fiscal policy volatility.

Such policies should be supported by sustainable, welldesigned, and stability-oriented fiscal institutions that can help build buffers during commodity price booms to prepare for any subsequent slump in prices. A strong commitment to fiscal discipline is critical for these institutions to be effective in achieving their objectives, the report said. - TradeArabia News Service