Dubai hotel rooms up 6.4%; UAE to add 24,500 units

DUBAI, September 19, 2023

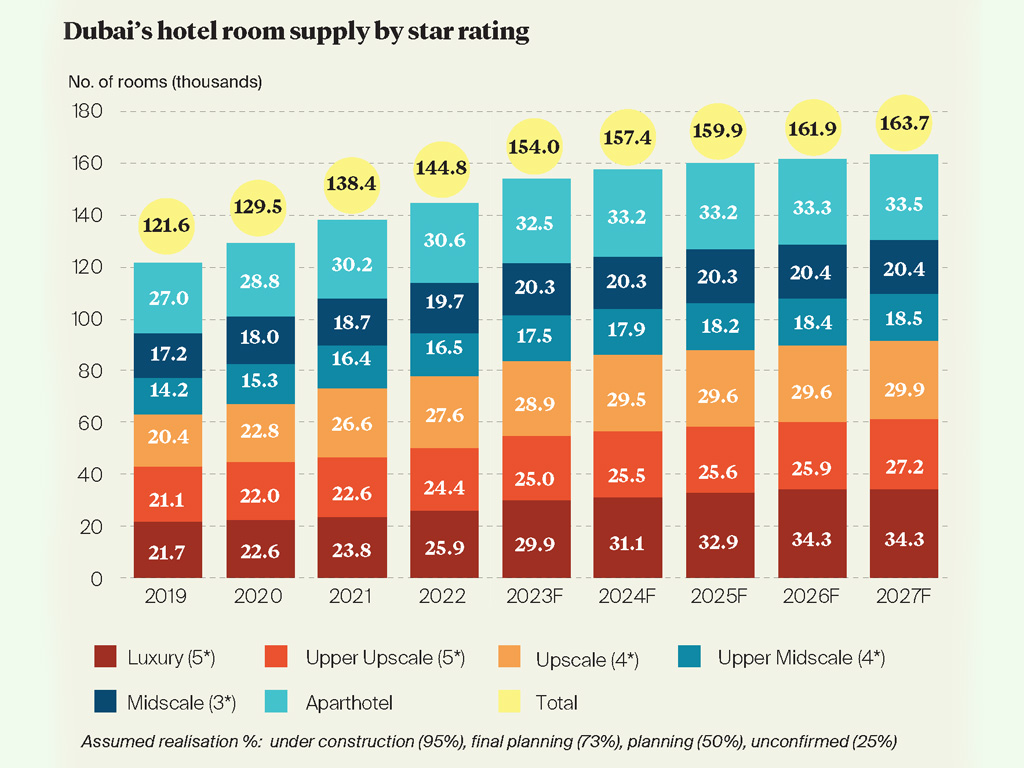

Approximately 154,000 rooms will be operating in Dubai's hospitality sector by the end of 2023, marking a substantial 6.4% increase from 2022, leading global real estate consultancy firm, Knight Frank, reports.

The UAE's dynamic hospitality sector is expected to add 9,200 rooms by the end of 2023 with an additional 24,500 rooms in various stages of development, further solidifying the city's global leadership in the hospitality sector. The UAE currently has a supply of 207,200 rooms.

Faisal Durrani, Partner – Head of Research, MENA, explained: “The UAE’s hotel inventory continues to expand, helping to support cities such as Dubai, which has emerged not only as the world’s most popular destination for two years running according to Trip Advisor, but the emirate has also earned the accolade of having the world’s highest occupancy levels during the first half of 2023 at 78%.”

Leading industry giants are driving this growth, with Accor securing the top spot, offering 71,820 rooms currently and 49,510 more in the pipeline expected for completion by 2030.

Following closely are Marriott International with 63,790 existing rooms and 52,790 planned; IHG Hotels & Resorts with 35,140 current rooms and 22,120 in development; Hilton Worldwide with 33,450 rooms and 39,860 upcoming; Radisson Hotels offering 22,830 rooms and planning an additional 11,651; and Rotana Hotels with 16,976 rooms and 10,807 in development.

Turab Saleem, Partner, Head of Hospitality, Tourism and Leisure Advisory, says: “Dubai continues to dominate the UAE's hospitality landscape, with 70% of the country's upcoming supply concentrated in the city. In H1 2023, Dubai welcomed 8.6 million tourists, marking a significant 20% increase from 2022. This surge underscores Dubai's enduring appeal as a global tourist hotspot. Internationally branded hotels constitute a 67% of Dubai's existing supply, highlighting the city's global appeal. A substantial 70% of the under-construction and final planning supply in Dubai belongs to the luxury and upper upscale hotel segments, catering to discerning travellers.”

According to STR data cited by Knight Frank, the Dubai market as a whole recorded a 0.8% increase in RevPAR compared to July 2022, driven by a 6.8% increase in occupancy but held back from further growth by a 5.6% decrease in ADR.

Category data from Hotstats for July 2023 showed most segments recorded minor ADR declines apart from luxury city centre hotels around Downtown, Business Bay, and SZR which recorded a 2% increase. Luxury beach resorts recorded a similar increase in occupancy as other segments but with a larger ADR decrease of 13%, it said. - TradeArabia News Service