$31 TRILLION: Goods and services trade jumps 13%

GENEVA, August 3, 2023

Trade in goods and services amounted to $31 trillion in 2022, a 13% rise year-on-year, according to a new report from World Trade Organisation (WTO).

While trade in goods exceeded pre-pandemic levels already in 2021, trade in services caught up in 2022.

China remained the top merchandise exporter in 2022 but its share in world exports declined to 14% (from 15% in 2021). The United States (8% of world trade) and Germany (7%) were ranked in second and third positions.

The share of manufactured goods in world merchandise exports fell to 63% in 2022 (versus 68% in 2018) mainly due to high energy prices limiting demand.

Trade in transport services continued to grow in 2022, although at a slower pace than in 2021 as shipping rates returned to pre-pandemic levels, the report said.

Intra-regional merchandise trade

Intra-regional merchandise trade represented 65% of Europe’s world trade in 2022, the highest amongst the major world regions. The lowest was for Africa (14% in 2022, down from 16% in 2018).

The value of merchandise trade expanded at a faster pace across the globe than volume in 2022, inflated in part by high global commodity prices.

Fuels and mining

World exports of fuels and mining products increased on average by 19 per cent per year between 2019 and 2022, reaching a value of $5.158 trillion in 2022. Their share in world exports increased by 4 percentage points during this period, rising to 21 per cent in 2022.

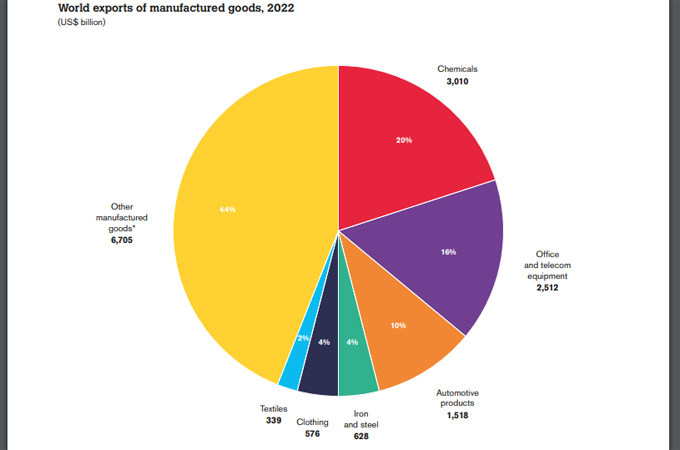

Exports of manufactured goods

Excluding “other manufactured goods”, chemicals ($3.01 trillion) and office/telecom equipment ($2.512 trillion) had the highest shares – 20 per cent and 16 per cent respectively – in world exports of manufactured goods in 2022. Automotive products ($1.518 trillion) represented 10 per cent of the global total.

World exports of intermediate goods

World exports of intermediate goods (IGs) – inputs used to produce a final product – fell from a 9 per cent year-on-year increase in Quarter 1 of 2022 to a 10 per cent decline in Q4. In value terms, they remained stable compared to 2021, amounting to $9.7 trillion.

Weakness in the exchange of industrial inputs in supply chains was largely due to a 0.3 per cent decrease in exports of manufacturing supplies, parts and accessories, which represent more than 85 per cent of IGs. Food supply chains remained the most resilient sector, with a 15 per cent increase in 2022.

Exports of intermediate goods by region

Exports of intermediate goods declined in Europe and Asia in 2022, by 1.8 per cent and 1.2 per cent respectively. North and South America, however, saw an increase of 5.7 per cent. An increase in South and Central America’s exports of industrial inputs in 2022 (8.5 per cent) was mostly due to Brazil’s supplies of raw and processed soybean products, which grew by 27 per cent (representing 28 per cent of its IG exports).

Africa’s trade in intermediate goods

Africa’s trade deficit in intermediate goods shrank to $4.4 billion in 2022. This is partly due to growth in its exports of intermediate goods, which totalled US$ 292 billion in 2022, an increase of 47 per cent

compared with its pre-Covid-19 level in 2019. A rise in value terms is largely due to high commodity prices.

Commercial services

In 2022, travel continued to bounce back strongly following the lifting of mobility restrictions worldwide. It is now on course for a full recovery and a return to its pre-Covid-19 levels, when it accounted for

almost one-quarter of services trade.

Computer services has been the most dynamic services sector over the last decade. In 2022, world exports were 44% above pre-pandemic levels. Growth was boosted by remote working as well as online learning and home entertainment. Globally, demand for software, cloud services, machine learning and enhanced cybersecurity continues to rise. Subdued growth in 2022, at 6 per cent compared with 22 per cent the previous year, is entirely due to exchange rate volatility, the report said.

Trade in transport services/travel

Despite recovery in many regions in 2022, air transport has only marginally increased compared to pre-pandemic levels. Exports of sea transport expanded due to high shipping rates in 2021. However, in 2022, growth slowed as shipping rates started to decline steadily since the spring.

Global exports of digitally delivered services

Europe accounts for more than half of global exports of digitally delivered services. Its growth levelled off in 2022, largely due to the depreciation of the euro and the British pound against the US dollar. Asia’s exports have been rising most, covering almost a quarter of the world’s digitally delivered services.

Leading traders

While China remained the largest merchandise trader in 2022, significant increases in the world rankings were achieved by Guatemala and Costa Rica, which moved up eight places to 76th and 77th place respectively. This was mostly due to an increase in Costa Rica’s exports of medical instruments and appliances and in its imports of electrical machinery and equipment. Guatemala’s rise was prompted by an increase in imports of petroleum products. India rose to 7th position in the ranking of services traders in 2022 thanks to a double-digit growth of 32 per cent, boosted by exports of computer services.

Least-developed countries' (LDCs) exports of goods increased by 41 per cent in 2022 compared with pre-pandemic levels in 2019 while commercial services remained depressed (-14 per cent). This was due to subdued recovery of international travel to Asian LDCs (74 per cent below 2019). By contrast, travel exports of African LDCs performed better, remaining only 9 per cent below their value in 2019, the report said. - TradeArabia News Service