Projects get new lease of life

01 December 2014

Kuwait has seen a steady increase in projects in the past year putting the construction sector on track and at the same time breathing new life into sluggish projects, says DHUSHYANTHI RAVI.

AN AMBITIOUS development plan is aiming to put Kuwait on the path to growth and economic reform and give a new lease of life to several stalled projects.

According to a recent report by Ventures Middle East, the value of construction contracts in Kuwait is expected to reach $17.5 billion by the end of 2014 from $9.8 billion in 2011 indicating that the country’s construction market is set for an upturn.

Some mega projects within the ambit of the new five-year plan (2015-2020) include the KD10-billion ($27.4 billion) railway network and a metro; the $4.8-billion airport terminal; the development of the Mubarak Al Kabeer Port on Bubiyan Island; Al Zour Two power project; Al Zour refinery; Madinat Al Hareer (Silk City), a proposed 250-sq-km city in northern Subiya; and development of Failaka Island off Kuwait’s eastern coast.

The Kuwait Development Plan (KDP) for 2015-2020, which was announced in August, is a twin-pronged plan expected to address the imbalances in the socio-economic development process by facilitating a bigger role for the private sector in the country’s development. In line with this, joint public private partnership (PPP) projects worth an estimated KD8 billion ($27.4 billion) are expected to be developed.

The second objective is to breathe new life into sluggish projects, which were part of previous plans – the government had spent just 57 per cent of the allocated budget in its last five-year development plan (2010-2014) as of January this year.

Kuwait’s economy registered a moderate growth, a government report said. The country’s GDP (gross domestic product) touched 1.5 per cent last year, registering a decrease of 6.6 per cent from 2012, according to Kuwait’s Central Statistical Bureau in its first estimate of the inflation-adjusted GDP.

On the downside, the decline in the oil price is hurting the economy of the oil-rich Gulf state with the head of the National Assembly’s budgets committee MP Adnan Abdulsamad warning that the country could be headed for a budget deficit in the current 2014/2015 fiscal year, having registered budget surpluses in each of the past 15 fiscal years.

Oil prices have lost more than a quarter of their value since June, hitting the state coffers of energy-dependent countries like Kuwait, where oil income accounts for about 94 per cent of revenues. But Kuwait is reported to have piled up massive fiscal reserves of more than $500 billion during the past 15 years due to high oil prices.

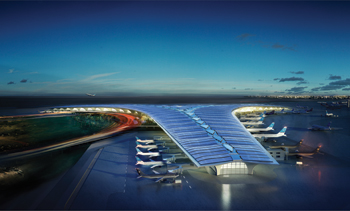

Airport

Among the major milestones in the construction sector was the award of the long-awaited contract for the expansion of Kuwait International Airport, the country’s only international airport (see Page 12).

A consortium of Kuwait’s Kharafi National and Turkey’s Limak Holding, which submitted the lowest bid of KD1.4 billion ($4.8 billion), has been selected to undertake the mega project.

The project entails the construction of a new terminal for the airport and a new runway in addition to around 30 gates to boost the facility’s capacity from the current seven million passengers to 13 million in 2016. The capacity is slated to increase to 25 million passengers by 2025.

The terminal has a trefoil plan, comprising three symmetrical wings of departure gates. Each facade spans 1.2 km and all extend from a dramatic 25-m-high central space. The terminal balances the enclosure of this vast area with a design that is highly legible at a human scale – for simplicity and ease of use there are few level changes.

The project targets Leed (Leadership in Energy and Environmental Design) Gold, aiming to be the first passenger terminal in the world to attain this level of environmental accreditation.

Railway & metro

In line with a GCC-wide drive to boost the transportation network in the region, Kuwait is spearheading the development of its metro, which will form an integral part of its transport system linking different modes of transportation.

Kuwait has confirmed the network layout for the new metro with construction due to begin in 2017. The $7-billion project will be divided into many segments in five phases, allowing many contractors to work on different lines in order to complete it in five years.

The 160-km K-Metro project, covering three lines and 69 stations – of which 65 per cent will be underground – will be part of a complete and modern transportation system that will contribute to transforming the country into a major financial and trade hub.

The project will be built on a build-operate-transfer (BOT) basis. Six government departments located in the planned metro’s path have agreed to shift to other locations while the remaining institution – the Kuwait Institute for Scientific Research – has been asked to move so construction work can start, according to an Emirates 24/7 report which quoted “senior ministerial sources”.

In addition, Kuwait is also developing the Kuwait National Rail Road System project, which will link with the GCC railway network. The project will be an integrated rail network with a total length of 511 km double track.

To be built on a BOT basis, the project is currently in the final process of design with budget allocation being already made and the tendering process expected to commence soon.

Roads

Key road projects being developed by Kuwait include Al Jahra Road development and Al Salami Highway expansion. The Cairo-based Arab Contractors Company said it has completed 70 per cent of the works of Al Jahra Road project, adding that it expects to complete as per schedule in early 2016.

Tenders for the project to expand Al Salmi Highway are expected to be issued early next year. The highway stretches nearly 100 km from Jahra City, west of the capital, to the southwestern Al Salmi outlet at the border with Saudi Arabia. According to Minister of Public Works Abdul Aziz Al Ibrahim, the project would be executed in three phases and would involve road expansion and the construction of new bridges and roundabouts.

Work is also in progress on the $3-billion Sheikh Jaber Al Ahmad Al Sabah Causeway, one of the largest infrastructure projects to be constructed in the GCC region. The 36-km causeway provides new strategic highway routes to facilitate planned development to the north of Kuwait City. The project aims to substantially reduce travelling time and bridge the marine link between Shuwaikh Port area and the Subiyah New Town area to the north which will help create a new residential area for up to 500,000 inhabitants. Some 27 km of the causeway is a marine bridge structure.

The project is expected to be completed in November 2018.

A KD169-million ($584 million) contract for designing, constructing and maintaining the Doha link of the causeway was signed recently. The 13-km Doha link will connect the Shuwaikh Port with the Doha motorway.

Refineries

Bids are due be submitted by the extended deadline this month (December 7) for Packages Four and Five of the Al Zour refinery project, which is expected to be the biggest refinery in the Middle East.

The refinery project, which has a capacity of 615,000 barrels per day (bpd) is being implemented in five packages estimated to be worth a total of KD3.3 billion ($11.6 billion).

State-owned Kuwait National Petroleum Company (KNPC) said in September it had agreed to extend bidding for packages One, Two and Three until the end of 2014 or the first week of January 2015 to give companies and consortiums a chance to meet the requirements.

The Al Zour refinery, coupled with expansion of the Mina Al Ahmadi and Mina Abdullah refineries, will double Kuwait’s refining output to nearly 1.4 million bpd within four years. The Al Zour refinery is part of the country’s Clean Fuels Project (CFP) and will help meet domestic demand and export of ultralow sulphur products.

Early this year, KNPC awarded a $12-billion project to British, US and Japanese-led consortia to boost capacities at key oil refineries in Kuwait and make production more environment friendly.

Work on the three-part CFP to upgrade refineries while reducing sulphur and carbon pollutants is expected be completed in five years. The Mina Abdullah One project was awarded to a consortium led by Britain’s Petrofac at $3.8 billion, Mina Abdullah Two to US Fluor-led consortium for $3.4 billion, while Mina Al Ahmadi went to Japan’s JGC Corp-led consortium for $4.8 billion.

The current production capacity of the two refineries of Mina Al Ahmadi and Mina Abdullah is around 730,000 bpd, while the capacity of Kuwait’s third refinery at Shuaiba is 200,000 bpd. Once the upgrade is complete, the capacity of the two refineries will be raised to 800,000 bpd, while Kuwait plans to shut the third refinery.

Commercial & residential

Gauging by two recent announcements, Kuwait seems intent on addressing the housing shortage that has plagued the nation over a number of years. The country last month indicated that it plans to construct a new city with 25,000 houses in the southern Al Ahmadi governorate, where authorities have already allocated land near Sabah Al Ahmed City.

The project follows the announcement of a housing scheme in late October involving the construction of 43,000 houses south of Saad Al Abdullah City in north Kuwait.

The country also has plans to develop Madinat Al Hareer (Silk City), which will feature the Burj Mubarak Al Kabir tower, a nature reserve, a duty-free area, a nearby airport, a large business centre and other facilities.

Kuwait is witnessing a surge in demand for real estate and a resurgence in development of commercial, residential and institutional projects. Among such projects is the prestigious Al Jahra Court Complex, work on which is well under way under a KD79.65-million ($273.71 million) contract awarded to Mohammed Abdulmohsin Al Kharafi and Sons Company (see separate article); and the Kuwait Oil Company’s oil display centre, which aims to narrate the history of oil in Kuwait (see separate article).

Among other key projects, Kuwaiti real estate firm Mabanee intends to spend KD265 million ($910 million) on building the fourth phase of its Avenues mall. Opened in 2007, The Avenues is the largest shopping mall in Kuwait and currently has more than 800 stores.

Tourism is another focus area, with the state-owned Touristic Enterprises Company (TEC) expected to launch a number of tourism, entertainment and sports projects to the tune of $460 million, giving top priority to the development of resorts, recreational facilities and a marina on Failaka Island.

These projects will be complemented by a raft of new luxury hotels, with 10,000 new rooms expected to come on line by 2015 – an increase in supply by almost one-third, according to the Kuwait Hotel Owners Association (KHOA).

The InterContinental Hotels Group (IHG) has four properties planned for Kuwait and Millennium and Copthorne recently signed a deal to manage the new 307-room Millennium Hotel and Convention Centre in the city, while Kuwait Municipality also has unveiled plans to develop an array of luxury properties.

Healthcare

Kuwait’s Ministry of Health has a number of hospital projects planned or under way including the Al Amiri Hospital renovation, $1.26-billion New Jahra hospital, the cancer centre, and the expansion of Adnan, Al Farwaniya and Al Sabah hospitals.

- Projects get new lease of life

- Kuwait projects at a glance

- Kuwait oil showcase nears completion

- Work on Jahra court complex under way