Construction output growth to plunge to 2.7pc

01 November 2019

The deterioration in construction output growth across emerging markets has been worse than previously expected, particularly in the US and the Middle East, according to GlobalData, a leading data and analytics company.

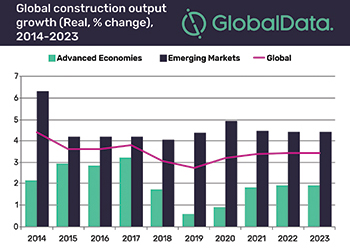

Therefore, the forecast for global construction output growth in 2019 has been revised down to 2.7 per cent, which will be the slowest pace of growth in a decade, stated the data company in its latest report, ‘Global Construction Outlook to 2023 – Q3 2019 Update.’

GlobalData’s central forecast sees global construction output growth increase to 3.2 per cent in 2020 and then stabilise at 3.4 per cent over the remainder of the forecast period, which runs to 2023.

This is partly driven by a projected improvement in the global economy in 2020, which in turn relies on improvements in financial market sentiment and stabilisation in some of the larger currently-troubled emerging markets, it added.

Danny Richards, lead economist at GlobalData, said: “Some major advanced economies have struggled to generate growth momentum, including the US, the UK and Australia. In China, where the authorities are stepping up investment in infrastructure to prevent a continued slowdown, growth will remain positive, contributing to a slight acceleration in total output in the emerging markets.”

“Geopolitical risks are intensifying, which could potentially undermine investor confidence and disrupt capital flows in the early part of the forecast period,” stated Richards.

Risks to the overall forecast, he said, stem primarily from a possible escalation in the trade war between the US and China, as well as inflamed tensions between the US and Iran following the recent drone strikes on Saudi Arabia’s largest oil processing centre, which were blamed on Iran.

The emerging markets of South-East Asia will be the fastest growing, expanding by 6.4 per cent between 2019 and 2023, he added.

- OMA unveils Kuwait residential tower design

- Construction output growth to plunge to 2.7pc

- Madinat Al Irfan Theatre work completed

- Work starts on Mandarin Oriental in Muscat

- Edamah, KHCB sign funding deal for car-park

- Doosan Bobcat opens EMEA HQ

- Dilmunia infrastructure work nears completion

- Oman announces plans to build $1.24bn medical city

- Bahrain airport terminal in ORAT test

- Sector spurred by urban, energy projects

- Assarain starts work on Duqm factory

- News in brief