Momentary lull

While the current Covid-19 pandemic has thrown the travel sector into the doldrums, the Middle East region is expected to push ahead – albeit with a heightened sense of safety and security – on its airport construction ambitions estimated to cost $222.3 billion, of which $92.8 billion worth of projects are reported to be in the execution stage.

01 July 2020

Airport construction and development has been thriving over the past decade or so, with countries in the GCC expanding their capacity to handle the soaring number of visitors to the region as well as transit passengers who use the convenient connections that the regional airlines offer to the international traveller.

According to Global Data’s Construction Intelligence Centre (CIC), airport-related construction projects in the Middle East and Africa are valued at $222.3 billion, with $92.8 billion worth of projects currently in the execution stage.

Saudi Arabia leads the airport construction pipeline with projects worth $58.6 billion, followed by the UAE with $57.9 billion.

Saudi Arabia’s General Authority for Civil Aviation (GACA) has been pursuing its ambitions for its aviation sector, and has recently completed work on the King Abdulaziz International Airport in Jeddah. Also planned is a 1.91-million-sq-m airport city adjacent to the airport, whichi is expected to become a leading destination for visitors from across Saudi Arabia and the GCC.

Among the projects being implemented in the kingdom is the expansion and upgrade of King Khaled International Airport in Riyadh – where two new terminals are being built; the proposed expansion of Dhahran International Airport; and the construction of new domestic airports including the first phase of King Abdullah bin Abdulaziz Airport in Jizan, and airports at Hafar Al Batin, Qunfudah, Abha, and Al Baha, among others. This apart, stunning airports are being built within each of the mega developments that are part of Saudi Arabia’s Vision 2030 programme, such as the one at the $500-billion Neom futuristic city and Amaala.

In the UAE, a new Midfield Terminal Building at Abu Dhabi International Airport is receiving its finishing touches, while the existing terminal continues to be upgraded and developed in keeping with the latest demands of the market. Dubai and the Northern Emirates continue to expand and upgrade their airport facilities.

Meanwhile, in Kuwait, work is ongoing on the new state-of-the-art Terminal Two project following the completion of the fast-tracked Terminal Four development (see Page 53). The world-class facility, which is aiming for a LEED (Leadership in Energy and Environmental Design) Gold certification, will have a capacity to handle 25 million passengers per annum.

In Bahrain, work is ongoing on the Airport Modernisation Programme, under which a state-of-the-art terminal is in the commissing stage. Work is progressing on the private aviation terminal project at Bahrain International Airport, and is due for completion by February next year.

Qatar intends to push ahead with the next stage of Hamad International Airport’s multiphase expansion project. Phase A will increase the airport’s annual capacity to over 53 million passengers by 2022, while Phase B, which will be completed after 2022, will further boost capacity to more than 60 million passengers annually.

Coronavirus Pandemic

The region will need to push ahead with these plans in anticipation of long-term passenger growth projections, despite the current Covid-19 crisis.

Undoubtedly, the ongoing pandemic has pushed the travel industry into the doldrums and seriously shaken the confidence of global travellers who, for some time, will book their air tickets with caution even if the airports worldwide threw open their doors to tourists.

Commenting on the impact of the health crisis to Gulf Construction, Samantha Solomon, Manager – Communications ACI Asia-Pacific (Airports Council International), says: “The impact of Covid-19 has put airports in survival mode. Demand in terms of passenger volumes is forecast to fall 47 per cent for airports this year. The estimated 2020 total revenue loss for airports in the Middle East region is $7 billion, representing a 52 per cent year-on-year decline. Job losses in aviation and related industries in the region could reach 1.2 million and GDP supported by aviation could fall by $66 billion.”

Over the past few months, given the high fixed costs of airports and the huge drop in revenues, airports have implemented a range of cost containment policies, both in terms of operational and capital cost, for example by closing terminals or runways where technically possible, and reducing or deferring investments. Airports right now are focused on restarting their businesses and regaining the confidence of passengers to fly again, according to the Asia-Pacific.

In the medium term, however, airports will have to re-evaluate their pace of expansion in order to meet passenger demand in the region and globally.

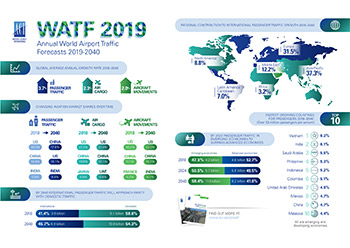

“Despite the hard-hitting impact of the crisis, traffic is expected to return to 2019 levels, however, in current estimates, not until 2023. ACI’s pre-Covid estimates show that the Middle East will contribute 12.2 per cent by 2040 to the global passenger traffic. Saudi Arabia and the UAE are among the top 10 fastest-growing markets. Many airports in the Middle East region are pressing ahead with capital expenditures, for example Dubai International Airport. What needs to be worked through now are possible new design considerations in light of public health measures,” Solomon points out.

Airports are already implementing social distancing and redefining safety measures in terms of layout and security to handle passengers in the post-Covid-19 era. Undoubtedly, airports that are in the planning stages or currently being built will now go through a thorough design re-evaluation to ensure that they meet the new challenges posed by the coronavirus disease and others. This is in addition to modernisation efforts as well as other measures to decongest and streamline passenger movement that have been ongoing.

According to Global Data, the ongoing airport construction projects across the globe have been valued at $737.3 billion. Of this, $212 billion is in the planning stage and Asia-Pacific accounts for the highest value with $241.4 billion, followed by the Middle East and Africa with projects valuing about $196.4 billion.

According to IATA, about $1.2 to $1.5 trillion is expected to be spent on global airport infrastructure development up to 2030.

- Momentary lull

- Aecom expertise for Kuwait terminals

- Mirage will turn to reality at Amaala

- Abu Dhabi airport gets touchless elevators