Study sees busy year for sector

A look at some of the interesting facts that emerged from the initial results of a survey entitled ‘Impact of Covid-19 on the Middle East FM Industry’ conducted by Middle East Facilities Management Association (Mefma) along with Frost and Sullivan.

01 August 2020

The spread of coronavirus (Covid-19) has affected all industry verticals, leading to a slowdown in global economic growth. One industry that will be challenged to meet the demands of the new normal as people get back to work and communities gear up to raise the bar on hygiene is the facilities management (FM) sector.

To address the extraordinary situation that is facing the world, this sector has implemented a series of programmes and initiatives aimed at alleviating the repercussions and ushering back a key sense of normality.

In line with this, the Middle East Facilities Management Association (Mefma), a non-profit professional organisation that aims to unify the FM industry in the Middle East, collaborated with business consulting firm Frost and Sullivan to conduct a survey regarding the impact of the pandemic on the industry. The initial results of the assessment were issued during a webinar conducted by the duo, entitled “Impact of Covid-19 on the Middle East FM Industry”, in late July.

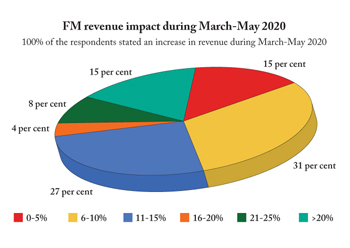

An interesting finding of the initial phase of the survey revealed that some 58 per cent of the respondents witnessed a six to 15 per cent increase in revenue during the March to May 2020 period, with 100 per cent of those responding stating that their revenues had in fact increased during the period. This included 31 per cent who reported a six to 10 per cent increase and 27 per cent who saw a 11 to 15 rise. A similar percentage of respondents anticipate a six to 15 per cent revenue increase for the rest of the year.

Looking at end-users’ willingness to spend for the mitigation of Covid-19 risk, respondents ranked the top spenders as being hospitals (97 per cent), followed by hospitality (79 per cent), government (76 per cent), retail (70 per cent), commercial offices: 64 per cent, public infrastructure: 59 per cent. residential: 49 per cent, and industrial: 45 per cent.

A total of 65 respondents took part in the initial phase of the survey to present their expert views regarding four key aspects of the sector: operational challenges in service delivery and response strategy; impact on cost, revenue and contacts; key technologies for future success in addressing Covid-19; and rebound strategies for a post-pandemic scenario.

According to Mefma, respondents to the survey included various workers of the industry, ranging from facility managers/general managers (48 per cent), directors (21 per cent), department heads (11 per cent), supervisors (11 per cent) and others (CEOs, vice-presidents and consultants) (nine per cent). Of the sample group, 52 per cent were from the UAE; 19 per cent were from Saudi Arabia; eight per cent from Kuwait; and the remaining 21 per cent came from various points of the region such as Oman, Qatar, Egypt, Lebanon, Turkey, Palestine, and India.

The preliminary results of the survey highlighted some of the operational challenges in the delivery of FM-related services, which included mobilisation of existing manpower due to the lockdown, supply chain issues/non-availability or delay in securing consumables, payment delays, manpower shortage, workforce morale, clients lacking budgets/knowhow/solutions aimed at reducing Covid-19-specific risk, increase in cost of consumables/tools, challenge in providing safe working environments.

The respondents also rated operational imperatives in terms of importance in the post Covid-19 scenario: Frequent cleaning and sanitation (96 per cent); deployment of technology: 81 per cent; additional requirements for compliance (76 per cent); additional training for manpower: 75 per cent; and changes in contracts: 63 per cent.

Speakers at the panel discussion were Stuart Harrison of Emrill, UAE; Mick Dalton of Diriyah Gate Development Authority of Saudi Arabia; Bader Saleem of United Facilities Management of Kuwait; and Hadi Al Irjan of John Hopkins Aramco Healthcare. The discussion was moderated by Abhay Bargava of Frost & Sullivan, Measa (Middle East, Africa and South Asia).

- Study sees busy year for sector

- Experts focus on the future for FM

- Rethinking strategies for the new normal

- Maintenance key to preventing failure

- Kärcher launches online support for cleaning

- Provis achieves key energy savings

- Eltizam unit nets over $201m FM contracts