Change in scope, a major risk factor in Mideast

The Middle East is among the regions where the construction sector is significantly impacted by disputed costs and overruns due to recurrent causes that are often predictable and can be avoided, according to a new report of the global construction industry by CRUX Insight.

01 January 2024

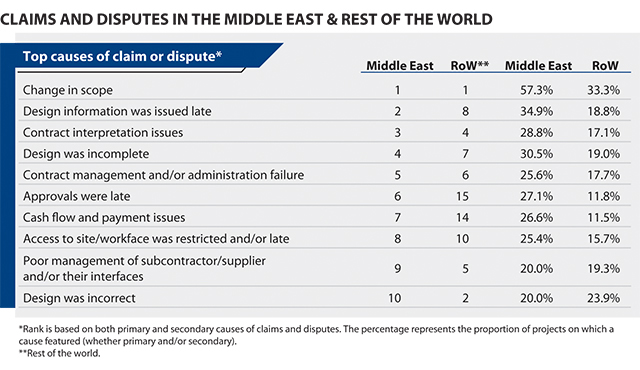

The construction industry in the Middle East is facing significant delays and cost overruns, with major projects experiencing schedule extensions averaging 82 per cent – compared to the global average of 67.1 per cent. The primary culprit for these delays and costs is change in scope, which causes disputes in over half of the projects in the Middle East (compared to only 33.3 per cent globally), according to new data revealed in the latest CRUX Insight report.

The report, now in its sixth edition, analyses claims and disputes in major construction projects around the world and reveals a staggering prevalence of disputed costs and schedule overruns. It states that the vast damage to major engineering and construction projects in the Middle East and worldwide results from recurrent causes which are often predictable and avoidable.

Speaking to Gulf Construction, Jad Chouman, a Partenr at HKA – a leading global risk mitigation and dispute resolution consultancy – says: “Construction projects in the Middle East continue to suffer some of the most significant delays, averaging 82 per cent of planned durations. The top-ranking causes of claims and disputes in the region tend to stem from optimistic timescales, compounded by the fast-track nature of the projects leading to incomplete design, changes to the original scope of work, and the late issuance of design information.

“CRUX indicates that ‘Change of Scope’ is a focal point of causation in the Middle East region; in my experience, these projects often go out to tender before the employer’s requirements are fully defined, or when designs are not adequately developed.

“The research also highlights other contributing factors not limited to contract interpretation issues, contract administration failures, and overly bureaucratic systems leading to late resolution of project disputes and resulting in cashflow and payment problems.

|

|

|

“On a positive note, we are seeing changes in the approach to contracting, such as the introduction of Dispute Adjudication Boards, which could help projects to continue while disagreements are resolved in parallel.”

“I believe that if CRUX insights are applied to major projects, this knowledge can lead to better outcomes for the benefit of all stakeholders,” Chouman adds.

Under the theme Forewarned is Forearmed, this year’s CRUX Insight surveys emerging risks – from political to environmental – as well as sharing insights into the most common lapses in the planning and execution of capital projects in regions and sectors.

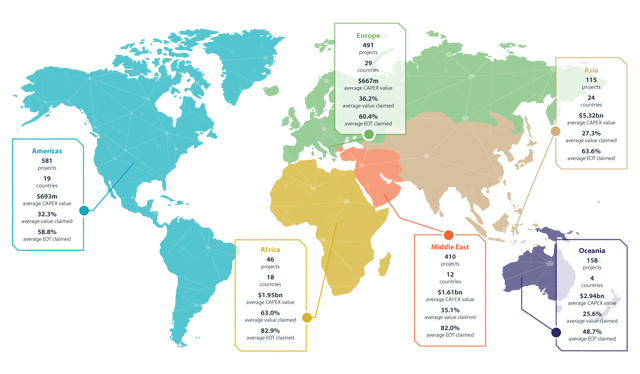

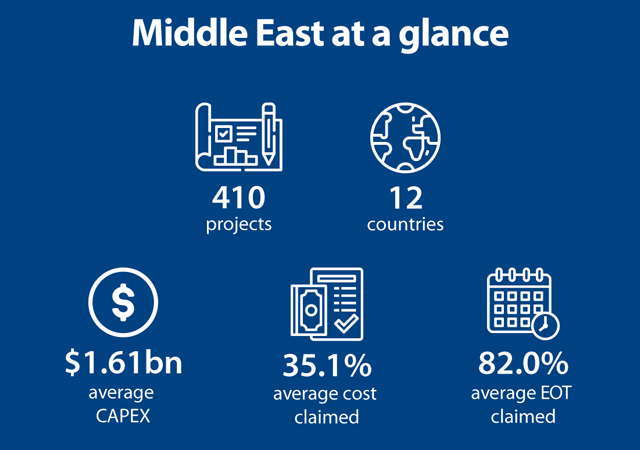

The report, published by HKA analyses over 1,800 projects in 106 countries with a combined capital expenditure (Capex) value of $2.247 trillion. The dataset includes 410 projects involving 12 countries across the Middle East, with an average value of $1.61 billion in Capex committed.

Some of the key findings of the report can be summarised as follows:

• Major construction projects globally are facing significant overruns in costs and delivery, with claims exceeding $91 billion in total value, and the cumulative overruns amounting to 876 years;

• Disputed costs averaged $100 million – more than a third (33.6 per cent) of capital expenditure;

• Claims for extensions of time (EOT) also reflect extreme project distress, typically prolonging planned schedules by more than two-thirds (67.1 per cent).

The report reveals that construction projects in the Middle East face more challenges than other regions when viewed in the broader global context. The CRUX data shows that:

• The total extension of time claimed in the Middle East amounts to 398 years - more than double the time in the Americas (199 years) and over fivefold the time in Asia (75 years);

• The leading cause of disputes is change in scope, which causes far more disputes in the Middle East than the global average. Over half of the projects analysed in the Middle East (57.3 per cent) were caused by a change in scope, compared to only 33.3 per cent worldwide;

• Contract interpretation is also a major issue across construction projects in the region, causing over a quarter of disputes (28.8 per cent) in comparison to only 17.1 per cent in the rest of the world;

• Cash flow and late approvals are also significant causes for disputes in the region, at 26.6 per cent and 27.1 per cent respectively. By contrast, these factors only impacted around 11 per cent of projects in the rest of the world;

• Scope change stymied more projects offshore, both oil and gas (53.6 per cent) and wind (45.0 per cent).

Renny Borhan, Partner and CEO of HKA, comments: “Modern megaprojects are increasingly complex, but the cruel conundrum for the global construction and engineering industry is that these most common causes of claims and disputes are highly predictable and largely within the control of the contracting parties.”

Significant regional variations

|

|

Middle East at a glance |

Deficiencies in design and workmanship loomed larger in Europe and the Americas. Incorrect design topped the European ranking, disrupting close to one in three projects (32.3 per cent), and ranked second in the Americas, where more than one in five projects were affected (20.4 per cent).

CRUX’s largest megaprojects were in Asia (where Capex averaged $5.32 billion), still much higher than next-in-line Oceania ($2.94 billion).

Time extensions neared two-thirds of schedules (63.6 per cent) in Asia – the only region where client-side management failures rose post-pandemic (from 29.7 per cent to 43.3 per cent). Change in scope – project enemy number one in Oceania – impacted 53.5 per cent of projects, but risks may shift with the end of Australia’s construction boom as investment tilts toward energy projects.

Scope change and design failures stymied more than half of Middle Eastern projects. Africa’s most persistent problems involved restrictions on access and cashflow, with spurious claims also disproportionate compared to the rest of the world.

The Middle East faced the worst prolongation of schedules – 82 per cent (only exceeded, slightly, in Africa). Sums in dispute were more moderate, but still amounted to more than a third (35.1 per cent) of average project Capex.

In terms of discrete causes, late design information ranked second in the regin (but eighth in the rest of the world) and triggered claims on almost twice as many projects (34.9 per cent). Late approvals (on 27.1 per cent of projects) and slow resolution of claims have negative ongoing effects on programme and costs. Again, more than one in four projects (26.6 per cent) were embroiled in cash flow and payment issues.

Despite this, the report perceives changes in contracting approaches in the Middle East, including Dispute Adjudication Boards (DAB) and early contractor involvement (ECI), though the pace seems to be lagging as markets overheat and demand expands, giving rise to more traditional methods of dispute resolution. Cost claims on oil and gas projects have ballooned to 46.2 per cent of Capex. There are also sharp intra-regional contrasts in project performance, notably with Qatar, the report adds.

The report emphasises the need for thorough and adaptable strategies to be adopted in the Middle East to secure resources for gigaprojects in the face of increasing competition and changing market conditions. While initial steps towards collaboration and risk-sharing are encouraging, they must be significantly expanded to effectively manage the complex procurement challenges.

Global sectoral anomalies and other insights provided by the report include:

• Design dividend: CRUX reinforces anecdotal evidence that extra time taken, amid the pandemic, to review and mature designs improved constructability.

Design failure rates dropped 12 percentage points globally after the hiatus (from 47.6 per cent to 35.5 per cent). That gap widened to 14 points in the Middle East and 18 in Europe.

• Wind of change: Despite the maturity of the wind-power market, offshore projects were still more likely to be thrown off course by change in scope (45 per cent) than other renewables or non-energy sectors. Onshore farms fared better than solar on schedules (30.6 per cent vs 53.4 per cent prolongation) but not on disputed costs (29.3 per cent vs 19.6 per cent of project Capex).

• Off track: Deficient planning and coordination largely explain an uptick in rail disputes. Changing scope contributed to more than half worldwide (57.1 per cent), closely coupled with incomplete design (40.3 per cent).

• EPC alert: Employers’ sense of security from all-risk engineering, procurement and construction (EPC) contracts may be false. The advantage over other forms of contract was less than expected in the power sector. But in oil and gas, EPC contracts endured worse prolongation onshore – averaging 71.2 per cent of schedules, against 60.1 per cent under non-EPC arrangements. Offshore, there was little difference between procurement routes as contractors sought extensions stretching to around three quarters of planned duration.

CRUX Sponsor, Toby Hunt, HKA Partner, adds: “The tougher economic context has intensified the uncertainty and risks facing infrastructure and capital projects. It is essential that the construction and engineering industry delves into the root causes of the most prevalent claims and disputes, and applies the lessons to current and future projects. Our growing dataset, CRUX Insight, and the interactive dashboard help employers, contractors and the wider industry do just that. The high cost of capital and the losses sustained through avoidable disputes make the case for proactive risk management all the more compelling.”

CRUX is HKA’s integrated research programme. The database (https://www.hka.com/crux-interactive-dashboard/) is searchable via an interactive dashboard, which can be used to gauge risks in various sectors and regions, benchmark causes, and help to identify areas for improvement.

Hands-on investigations by its consultants – on mainly multi-year megaprojects up to August 2023 – underpin the report’s analysis of the factors driving claims and disputes.